Millions of small and medium businesses still operate inefficiently due to dependency on manual processes, which limits their capacity to grow and scale; this is despite contributing to about 48% of Nigeria’s GDP in the last five years,

But the tide is turning. Over the last couple of months, we’ve seen a wave of upstarts launching solutions geared toward digitizing small business operations. In the latest development, Bumpa, one of them which says it is building the infrastructure to power online commerce and enable African small business owners to start, manage and grow their businesses from their mobile devices, has raised a $4 million seed round.

The company, which announced a $200,000 pre-seed last September, said it intends to use the investment to hire talent, build up its processes, structure, and scale into new African markets.

The platform’s origin story can be traced to 2018 when founders Kelvin Umechukwu and Adetunji Opayele — while running another startup that involved consulting for small businesses — built websites for small business owners interested in coming online for the first time. Subsequent versions were tailored in Shopify’s image: a basic website builder small businesses could use without much assistance.

However, after gaining little traction, it was clear that Bumpa had to evolve to meet the growing demands of businesses on the platform, including recording sales and bookkeeping, inventory tracking, and storing customer details. It also helped that both founders came from families of small business owners, so they had a firsthand view of these problems.

And as businesses moved online in droves when COVID hit in 2020, Bumpa returned to the drawing board, revamped its product and launched a new version into the market the following year. This version lets businesses create websites in “60 seconds,” accept payments, manage inventory, handle bookkeeping, fulfil orders and engage customers.

“We’re trying to solve the inefficiencies small businesses face as most of them have operated in a black hole for the longest time. They don’t have enough data and insights into what’s happening, what’s being sold and how their products are being sold,” CEO Umechukwu said on a call with TechCrunch. “While many startups are trying to solve this, we’re doing it differently. We’re evolving, and we consider our features as the foundation of what is possible with Bumpa.”

Bumpa 2.0: Integrating an ecosystem of products

These days, small businesses in Nigeria are spoilt with options, in addition to Bumpa, for products that can digitize their operations, including bookkeeping, invoicing and inventory management. Some include Pastel, Kippa and OZÉ.

In August, Bumpa made a move that conveyed a message: It approached its relationship with small businesses differently as a retail automation company, not an embedded finance platform.

“I think the ideology and the product direction between Bumpa and other companies differ. Most of them have fintech elements; we are not trying to be fintech — we’re in the retail automation space,” CEO Umechukwu expressed. “We’re not trying to solve things in fintech that have already been solved. There are new things that have not been tested before, like the Meta integration.”

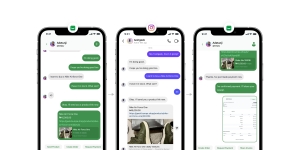

Bumpa’s integration with Meta allows its merchants to connect Instagram and Facebook accounts to their Bumpa app, receive DMs from their customers and respond via the Bumpa app. The integration also lets them share and sell products, share invoices/receipts, record sales, store buyers’ information and request payments on the Bumpa app while it reflects on their customers’ Instagram DMs. All these transactions occur without the merchants leaving Bumpa and the buyer leaving Instagram.

Several tech observers have lauded the Meta integration, which, according to Umechukwu, will carry Bumpa to its next phase: bringing various digital solutions essential to the daily operations of small businesses and integrating them under the social commerce and retail automation platform.

“There’s so much fragmentation in the space. A business owner probably uses up to 10 solutions, including social media, payments, invoicing, logistics and marketplace apps. But none of these solutions communicate with one another,” he said. “We want to be that connecting platform on the continent. The idea now is to connect all of these solutions and channels that small businesses use together with a click of a button and basically facilitate the transfer of information for efficiency.”

That said, Bumpa would not be heading into this Herculean task blindly. It will prioritize based on orders and activities completed on the platform. For instance, what drove the Meta integration was that 40% of all the orders on Bumpa come from Instagram and WhatsApp. And in a subtle bid to bring conversational commerce to over 50,000 small businesses on its platform, the next couple of integrations will include WhatsApp, Messenger and Google My Business. The play is similar to what Charles has in Europe.

The Bumpa app

These integrations are not free, though. Bumpa has latched them to a subscription plan to complement its first revenue stream: commissions on online transactions. Umechukwu said subscriptions have doubled Bumpa’s revenues from Q2 to Q3 this year. Generally, Bumpa has completed over 200,000 orders since its inception and recorded a GMV of more than $20 million.

Base10 Partners, the world’s largest Black-led fund, is the lead investor in Bumpa’s seed round; it’s the firm’s second investment in Africa after Okra, a Nigerian API fintech. Other participating investors include Plug & Play Ventures, SHL Capital, emerging markets-focused fund Magic Fund, Jedar Capital, DFS Labs, FirstCheck Africa Angel Program, E62 Ventures, Club14 and Fast Forward Ventures.

Fast Forward Ventures’ managing partner Opeyemi Awoyemi said Bumpa is doing what Shopify did in North America for Africa. And citing why his firm is doubling down on the social commerce platform after an initial $30,000 pre-seed check, he said Bumpa is “unlocking prosperity (and huge GDP) for millions of new and existing sellers.” The firm’s operating partner, Omolara Awoyemi, is Bumpa’s chief operating officer.

Meanwhile, in a statement, Luci Fonseca, a principal at Base10 Partners, said Bumpa is enabling e-commerce and reducing friction for millions of SMBs. “The more we spent time with Kelvin and Adetunji Opayele (Teejay), the more we saw that they are very special founders and have a powerful mission to build the defining e-commerce platform in Nigeria and across Africa,” she added.

Nigerian retail automation platform Bumpa raises $4M, led by Base10 Partners by Tage Kene-Okafor originally published on TechCrunch