Blockchain-based games have seen a surge in popularity, but playing them is getting expensive. Play-to-earn games like StepN require players to purchase an NFT before they can participate, while other crypto video games offer users pricey upgrades such as virtual avatars and distinctive skins or costumes.

Halliday, a startup founded last November by Akshay Malhotra and Griffin Dunaif, is building a “buy now, pay later”-style financing product targeted toward gamers who want to pay off in-game purchases over time.

“It’s quite remarkable that video games, these virtual worlds, now have fully-fledged market economies. In these worlds, you have digital property, digital ownership, and items with real-world value. One thing we were struck by was that because these things have real-world value, it can actually be quite difficult to acquire them and have ownership, and one of the fundamental tenets of blockchain is that ownership,” CTO Dunaif told TechCrunch in an interview.

As is the case with many traditional BNPL providers such as Klarna and AfterPay, Halliday’s product will be interest-free for users, CEO Malhotra, who previously worked in the hedge fund space, said.

Unlike with traditional BNPL providers, though, Halliday won’t charge penalty fees to users who default on their payments, Malhotra explained.

Instead, he described Halliday as a “repo” product. Gamers can purchase an in-game asset with a Halliday extension at checkout and start using it immediately, but the asset will be stored with Halliday until it is fully paid off, Malhotra said. Once the payments are complete, Halliday will transfer custody of the asset to the gamer, he added.

If a gamer doesn’t pay what they owe on time, rather than reporting the delinquency to a credit agency, Halliday will just take back control of the digital asset, according to Malhotra. Halliday has developed its own smart contracts that “wrap” NFTs, meaning that gamers possessing those wrapped NFTs can use the underlying object but cannot sell, transfer or hold the rights to the NFT itself. Game developers, too, often have their own internal access mechanisms that would prevent a user from taking possession of a virtual asset and holding onto it if they aren’t authorized to do so, he added.

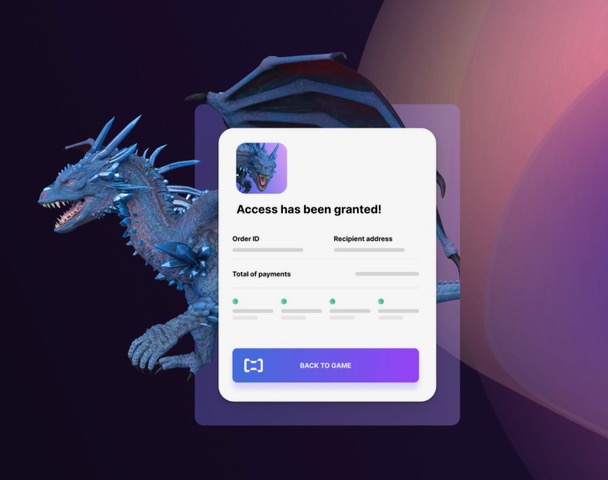

Concept art for Halliday’s platform Image Credits: Halliday

Though Halliday plans to charge an initial fee to customers using the product to cover the startup’s costs, Malhotra hopes to eliminate the fee over time as his goal is to keep the product as low-cost as possible for gamers. The founders did not share any further detail on their monetization plans, noting that they are still focused solely on building the product itself.

One major consideration for Halliday will be how to model risk associated with its loans since the company will be paying game developers upfront for digital assets on behalf of its users.

“There are not that many comparables for how to model risk for something like this, so this is where our team has been working to try to come up with innovative new approaches,” Malhotra said.

As for time frame, Malhotra noted that gamers will eventually be able to decide how long they need to pay off a given purchase with Halliday. The founders envision that average terms will be around 1-3 months to start, he said.

The six-person team plans to launch its product in a beta partnership with League of Kingdoms in a few weeks, Malhotra said. A full public launch is expected to take place shortly after the beta, he added.

In preparation for the launch, Halliday has raised a $6M seed round led by a16z crypto, with participation from Hashed, a_capital, SV Angel, Immersion Partners, Sabrina Hahn and others, according to the company.

Already, many video games that have in-game purchases allow players to rent virtual objects. But Malhotra and Dunaif argue that a product like Halliday that enables ownership is still in-demand.

“If you look at comparable, real-world, economic markets, like cars, like housing, you see that there’s always rentals, leasing and ownership — but there is a huge preference to own,” Malhotra said. “If there’s a way that you can own and get all the benefits associated with ownership, such as the emotional attachment, the emotional benefits, the economic benefits, everything else attached to that, and if there’s a solution for that, there should be demand for it.”