There’s around 250,000 hair and beauty professionals working across the U.K., and Glambook wants to be the sharing economy platform that takes care of them.

The company recently raised $2.5 million at a $12 million valuation, and I managed to talk it into letting me share its pitch deck with you to see how the company wove its story to its investors.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Glambook raised its investment with a 19-slide deck, and they agreed to share it with us in full:

- Cover slide

- Problem slide

- “Unsolved for a reason” — opportunity slide

- Solution slide

- Value Proposition slide

- “People love our product” — product validation slide

- Market slide

- Addressable market slide

- Traction slide

- “Why Now” — timing slide

- Positioning slide

- Business Model slide

- Go-to-market slide

- Road map slide

- Social Impact slide

- Team slide

- “Here is our story” — the “why us” slide

- Summary slide

- Contact slide

Three things to love

For an early-stage company, Glambook has a lot going for it — it is seeing meaningful traction and operates in an interesting market. The biggest challenge the company has to overcome is convincing investors that this is a market that is, indeed, clamoring for a technology makeover. And it does a pretty damn good job.

Here are three things that work particularly well:

Tractiooooooooooooon

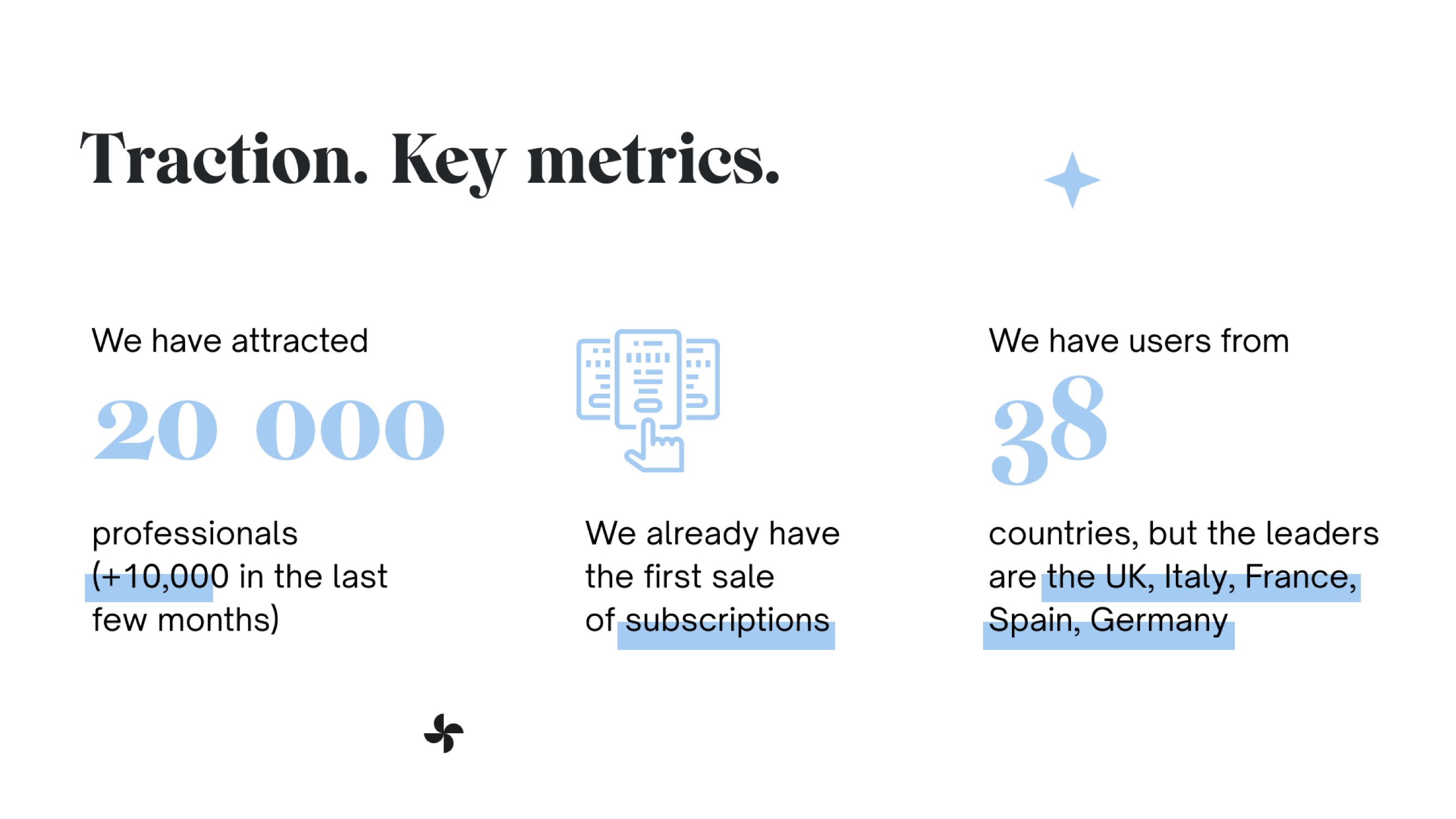

[Slide 9] Traction: if you have it, you’re giggling all the way to the bank. Image Credits: Glambook

Is your team awful? Is your product garbage? Is your market niche? I’m not saying that any of those things apply to Glambook, but in general, none of it matters if you have traction.

You can counter almost every question with: “Perhaps it’s stupid, but look at the numbers. It’s working!” Really, the question becomes why it works, and if you can keep it working, even at scale.

For a relatively small, $2.5 million round, having 20,000 customers across 38 countries is impressive. (Although I also note that the most important traction metrics — How sticky is it? How many orders are facilitated? How much revenue is being generated? — are missing.)

The story Glambook is selling here is that “Things are changing, and we are right there as it does,” which is the perfect place to be as an early-stage startup.

More importantly, saying there are subscription sales happening without including monthly or annual recurring revenue figures isn’t great storytelling. I’m impressed by the number of countries and the number of professionals on this slide, but I also want to know the number of clients and the value of the subscriptions. Not including those figures makes me immediately suspicious.

Those are asides, though. The company is showing real, measurable, important figures. The takeaway here is that if your company has those, show them off with pride. Why? VCs invest in inherently high-risk businesses. Any traction — and any progress — goes a long way toward showing that the business is at least partially de-risked.

As I mentioned, if you’ve got traction, you’re doing something right, and that something can probably be developed into a good company one way or another.

A rising tide

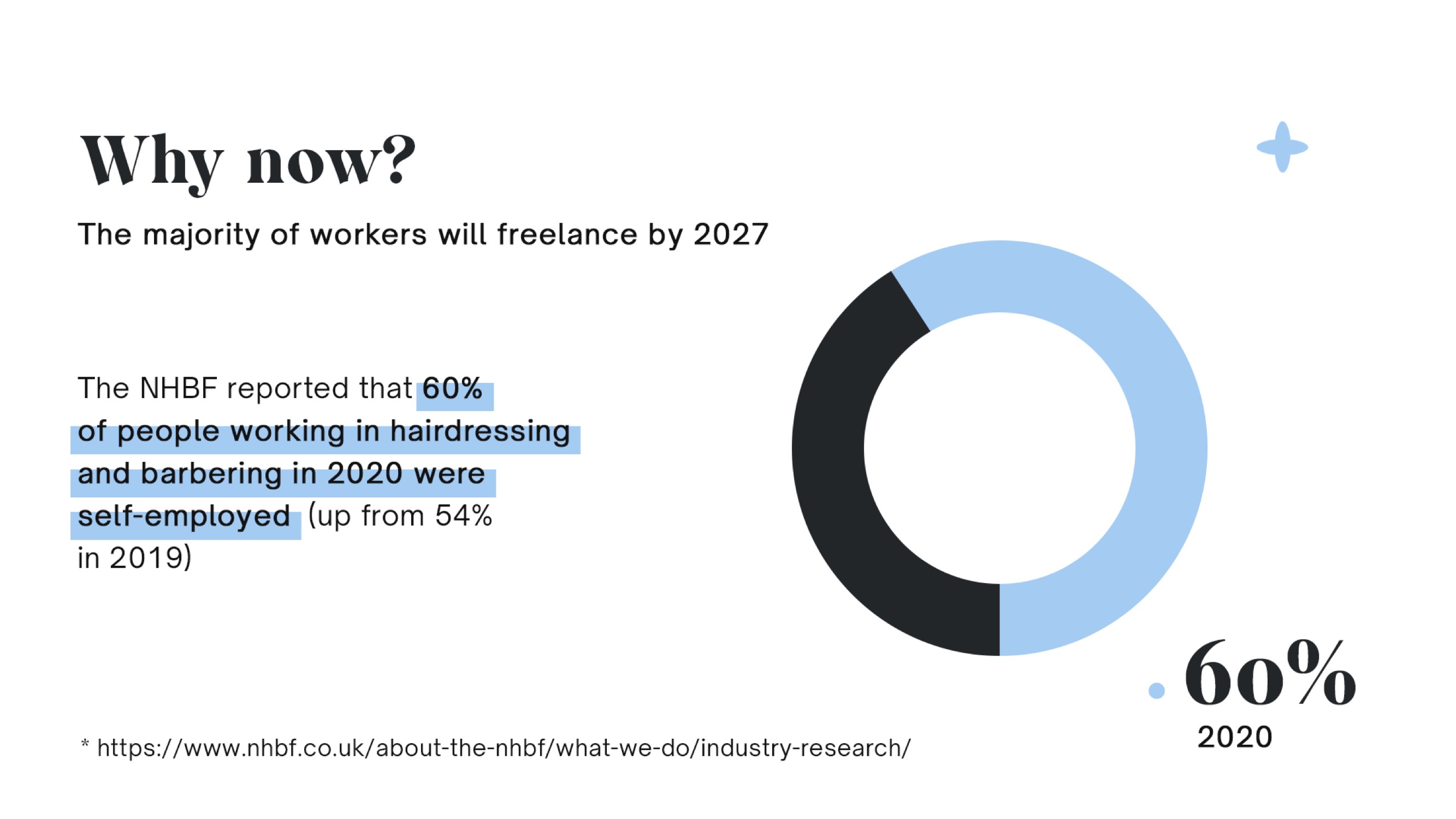

[Slide 10] A rising tide raises all boat. Image Credits: Glambook

Glambook uses this slide to tell the story of a market in evolution. In 2019, 54% of hairdressing and barbering professionals were self-employed, and by 2020, that had grown to 60%.

I’d have loved to have a graph pulling this data back further into the past for a longer timespan so I could see more of a trend, but there’s something powerful happening in this market, without a doubt. The story Glambook is selling here is that “Things are changing, and we are right there as they do,” which is the perfect place to be for an early-stage startup.

If you can weave macroeconomics and big societal changes into your pitch and show off how you are benefiting from them, you potentially have a winner.

This slide is titled “Why now,” but I think it walks hand in hand with another slide, titled “Unsolved for a reason.” I’ll talk more about that later, but suffice it to say that with this deck, the company signals some of its biggest challenges without offering a 100% satisfactory answer.

“This market is bigger than you’d think”

[Slide 7] A huge opportunity. Image Credits: Glambook

A lot of the time as a VC, you’ll be pitched companies in industries and markets you aren’t that familiar with. I had to sit with that for a moment in this case.

Beauticians, hairdressers and barbers — is that really a big enough market to build a business empire around? The U.K. has a population of 67 million or so, so if those numbers are okay, there’s around 1,400 people per hair and beauty business. That would have to mean that around 4% of the U.K. population works as beauticians, hairdressers and barbers.

Just as a gut check, that sounds a little bit high to me, but a quick Google search results in the article the company cites on this slide, which seems to confirm those numbers. That is exciting, not least because a few searches also don’t identify a clear market leader in this space. Could Glambook become that market leader?

The pitch here is slightly unfocused: Glambook is a Berlin-based company that uses a lot of U.K.-based stats while also saying it has customers in 38 countries (I’ll get to that in just a moment as well.). The important part of this particular slide is illustrating that there’s a huge market that’s ripe for disruption.

As an investor, that’s the kind of thing that makes me lean forward and pay extra attention.

In the rest of this teardown, we’ll take a look at three things Glambook could have improved or done differently, along with its full pitch deck!