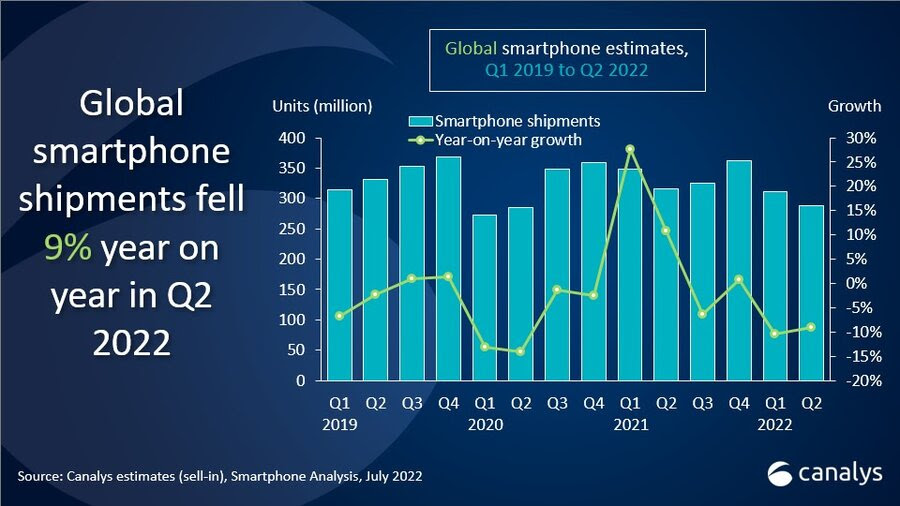

More smartphone struggles, as reports trickle in for Q2. Per Canalys, global shipments dropped 9% for the quarter, reversing a brief recovery for the category, whose woes have only been amplified by the pandemic, ensuing shutdowns, supply chain issues and persistent economic uncertainty.

The 287 million units represent the lowest figure since Q2 2020, when the pandemic started. Interestingly, the confluence of longstanding concerns have led to new issues – namely oversupply. Slowing interest have saddled companies with back stock on older models.

“Supply chain shortages are no longer the most pressing issue as component orders are being cut rapidly and suppliers have started to be concerned about oversupply,” analyst Tony Zhu notes in a release. “It has resulted in price cuts for key components, which reduces costs for vendors. Vendors could use the extra savings to improve the product competitiveness of new launches in the second half of the year. At the same time, that might make getting rid of old models even harder. The oversupply situation is demanding more of vendors’ planning capabilities than the shortage period.”

There’s been a lot of correction happening in the industry, coupled with a good deal of uncertainty. A category that has effectively trained consumers to anticipate annual spec updates is also understandably having difficult moving older models. Device makers will press on, of course, adopting a range of different strategies to cope with the crunch.

Image Credits: Canalys

Samsung fared the best, maintaining the top spot with 21% of the market. The company has shifted much of its focus to the budget-tier A-Series – after all, people still need phones, even if inflation and uncertainty have made purchasing $1,000 flagships largely untenable. On the flip side (so to speak), the company is also continuing to push its pricey foldable strategy as the way forward.

Samsung is expected to announce a pair of new devices next month. The company says it shipped nearly 10 million foldables in 2021 alone.

Apple, meanwhile, has held onto second on the lasting strength of the iPhone brand. The iPhone 13 defied expectations as the company highlighted a slight revenue increase in last night’s earnings report, defying broader economic headwinds. A good indication, perhaps, for remaining consumer confidence, in spite of macro trends. Earlier this week, a report noted that the Chinese market saw a sharp 14.2% decline in sales, owing to lockdowns and lowered consumer confidence.