What if museums were curated and funded by the internet, and allowed pieces to stay close to their cultural roots, displayed in a context that made sense? Native art in native museums, religious artifacts shown in temples, mosques and churches, and so on? That’s the premise of Arkive, which just raised a $9.6 million round of funding, bought the original patents for the world’s first electronic computer — the ENIAC — and is launching out of stealth this week. TechCrunch spoke to the company’s founder, Tom McLeod, to find out why we need a blockchain-powered museum.

Let me just start by saying that I’m generally pretty bearish on blockchain tech, and nobody in their right mind would pitch a crypto startup to me. This one caught my eye, however, and it is with great reluctance and grumpy-old-man-ness that I’m willing to leave the door ajar to the possibility that this may actually be a sensible use of the technology.

The company’s goal is to create a community of everyday people who want to curate, own and create culture by opening access to one of the most exclusive asset classes ever created: museums. It also aims to solve something museums have traditionally had a monopoly on: deciding what art is significant enough to preserve, and worthy enough to display. The company is planning to be a counter-weight to the fact that only a tiny fraction of collections are being displayed to the public, with more than 90% of items being locked away in private collections.

The company’s founder, McLeod, is not in his first rodeo. His previous startup Omni was acquired by Coinbase, and he’s had a number of other exits in the past, including Pagelime, which SurrealCMS acquired in 2015 and LolConnect, which was snapped up by Tencent three years earlier.

“Arkive is an entirely new down-up model where everyday people are part of curating the collection and defining an item’s artistic historical relevance and place in culture,” said Tom McLeod, founder and CEO of Arkive in an interview with TechCrunch. “When we set out, we asked, ‘What if the Smithsonian was owned and curated by the internet?’ and that’s what led us to launch Arkive. We are hell-bent on building a vibrant community that’s part of defining historical significance.”

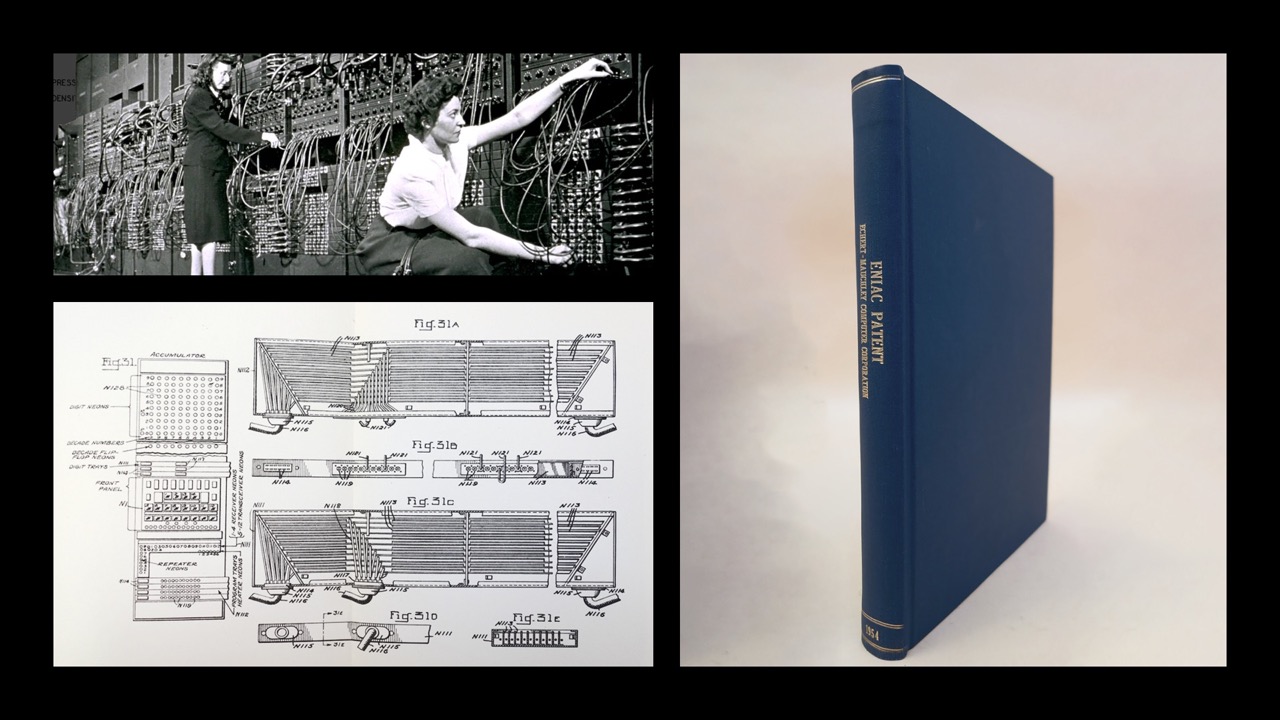

Arkive acquired the original patent for the ENIAC computer. Image Credits: Arkive.

As a decentralized autonomous organization (known as DAO among brevity-loving friends), Arkive’s collections are curated by its members, who vote on which items they want to acquire. The idea is to transfer these to non-fungible tokens (NFTs) that replace, store and manage all historical provenance, authentication, quality and condition on the blockchain. As McLeod describes it, the blockchain tech is essentially there to capture the metadata of the item itself, and to enable fractional ownership of an item.

The first item the community elected to buy was the original patent for the ENIAC — widely recognized as the world’s first programmable, electronic general-purpose computer. The patent itself is long expired, of course, but as a historical artifact, it’s a wonderful curiosity.

In a delightfully geeky video, the Arkive team shares why it’s excited about the ENIAC patent:

The origins of Arkive

The idea for Arkive came out of McLeod’s previous business, which was a storage company that got out-competed by Clutter and its very deep pockets. Storing bikes and snowboards and tents didn’t capture his attention; but something else did.

When you view religious items in secular spaces, it dramatically changes their impact. Tom McLeod

“I would see every day where a cool or interesting or unique item would come in. Or something extremely valuable,” McLeod said in an interview with TechCrunch, telling me how the most unique and valuable things went into separate little rooms. “We would have things like Spider-Man No. 50. Slowly, and over time, those rooms started to look more and more like little galleries or little museums. I literally would go in those rooms at least once a week and just see all the new stuff.”

It turns out people on the internet have a lot of deep knowledge and interests about the most obscure things. These aren’t art curators — these are regular people with a specialized interest. They may not have the money to buy the things they are interested in, but what they lack in capital, they have in passion and knowledge.

“Arkive started as an idea. What if you took all this knowledge of the commons and put people into a spot where they could suddenly communicate that knowledge, share it with each other, learn, and be a part of the acquisition committee. This idea evolved into having an on-chain Museum,” says McLeod. “My track record at this point is that I build what I say I’m gonna build. I don’t know if that means it’s going to be successful. But when I say I’m gonna build a museum on-chain, I’m gonna build a museum on-chain!”

Why crypto?

I challenged McLeod to explain why he couldn’t just go build himself a museum with a pretty website, rather than adding blockchain tech to the mix.

“There are things that crypto does really well. It is already established crypto does a good job of fractionalizing complex financial contracts. It actually does a very good job of ownership and removing ambiguity. You could probably do that without the chain, but usually, those other solutions still require human interaction or middlemen. Crypto does access to voting and fractionalization of ownership so well,” explains McLeod.

In addition to ownership, voting and contracts, another aspect of the blockchain works for art, too. Specifically, NFTs, but not as we mostly know them today.

“On the NFT side of things, we’ve probably seen the simplest and — in my personal opinion — maybe the least compelling utilization of that technology,” says McLeod, arguing that the technology is in its infancy. “Simply saying you can take an attribute that can be permanently locked onto a blockchain (say, a JPEG or a link to a file), and to say ‘we’re now we’re going to trade that’ is probably the bare minimum of value that you could create using just the core concept of a non-fungible token.

“When I started looking at what’s the combination of those two things is, I realized that we had that kind of in the infrastructure at Omni. You would hand your stuff over to us, and you are functionally granting us (at least for a while) the temporary right of ownership. That’s because that’s the only way we could have insurance. Once it entered our vehicles and returned to you, we returned the ownership. That’s how we were able to keep insurance going,” says McLeod. “That was actually super complicated to work with; when we started thinking about who owned what and where, also became a huge problem for us because we had to have a constant chain of custody. So when you hand it to the driver, it got scanned with a barcode and then you hand it to the guy that was on the truck and it got scanned. Then it left the truck, and then got scanned at the photo station. They got scanned into a location in the warehouse. To return it, you then reverse it all. We had this very intense line around chain of custody, and that’s basically short-term provenance.”

Bored of art-world shenanigans

Of course, we’re not talking about the time frames of a tent that you’re not using until your next camping trip. Arkive points out that it wants to build a museum that will work for centuries or millennia, but the core of the ideas started with tents and bikes and kayaks.

“If you could start moving all of the provenances of the items on-chain, and you have opportunities to do things that work well in a blockchain fashion — voting, verification of voting, lack of fraud, who actually did what, this is the wallet that signed up, this is the wallet that’s voting. There’s no way to move around that: You can create a pretty good representation of like a meritocratic system; a curation committee at the top of the museum,” says McLeod. “You move those objects’ provenance on-chain, so now it is all public. Where did it come from? Whose was it?”

Arkive, in particular, is bored of the shenanigans that are going on in the art world, and points out that a lot of those shenanigans are coming up again in the NFT world. What McLeod wants to build is a transparent world where everything can be verified and checked by anyone who wants to.

Could you do that with a database rather than the blockchain? Maybe, but McLeod argues that databases can be changed, and if there’s enough money or emotional connection with the items in play, that introduces risk.

“I think there’s pieces of our idea that you could replicate with a database. But it wouldn’t be subject to the same tainting, changing of records. To avoid that, you’d have to open source your database. Basically, a blockchain is a giant open source database with a lot of trust and verification. So that’s where I came to: I thought this was the best technology to do it with,” says McLeod. “If you look down the road, the opportunities [the blockchain] gives you around fractionalization; things could come out of that. I care very little about tokens going up or down or the speculation side. I think the core blockchain technology works really well when it comes to the transparency of who owns what, where, when, why, and how did it get there and where is it now.”

No physical museum

The company is creating a very complex NFT bundle that stores all the rich data around the items that are part of the museum. It argues that using the chain enables levels of temporary lending of museum pieces, and potential collaterizing against a piece becomes possible. The company isn’t currently planning to create a physical space.

“That’s not just because maybe I’m tired of running giant warehouses full of things,” laughs McLeod, but when challenged, admits that he might be uniquely positioned to do just that. “I’d say the founder/market fit is very high [for operating a physical museum] because I know what it takes to run such an organization. I know how to move expensive physical items and store them across multiple states.”

The company’s vision goes beyond just the acquiring of items, however; it highlights a challenge with art and artifacts that is all-too-familiar for modern museum-goers.

“If we acquire a work from an indigenous artist, we don’t need to put it in the British Museum. We can put it in the closest museum that was near its actual creation, where they were inspired, or where they want it. We could talk to them directly and work on a partnership to get it in a place that matters to them — we can maximize the impact,” says McLeod. “There’s a lot of really interesting articles on religious art and how so much of religious art was meant to be put into religious institutions. They were supposed to be in temples and mosques and churches. And now a lot of the most important religious art is actually in museums. When you view religious items in secular spaces, it dramatically changes their impact.”

Lynn Hershman Leeson (left) and her 1985 work Seduction, which was the second artwork acquired by Arkive. Image Credits: Arkive (opens in a new window)

In addition to the patent for the ENIAC, Arkive has also acquired Seduction (1985), a vintage print by Lynn Hershman Leeson, which, like the ENIAC patent, will be a part of Arkive’s traveling exhibition in late 2022. The idea is that the print will enter into long-term residency at a prominent public location selected by the Arkive membership.

Arkive produced a short video of Seduction as well, highlighting why it found it a worthy addition to its collection:

The funding round

The company is announcing a $9.7 million funding round, led by Offline and TCG Crypto with participation from NFX, Freestyle Capital, Coinbase Ventures, Not Boring Capital, Precursor, Chainforest, Coil, Julia Lipton, Joe McCann, Chris Cantino, Marty Bell, Paul Veradittakit and many others.

“This is not a museum in the metaverse filled with expensive digital images of expensive monkeys and NFTs,” said Nate Bosshard, partner at Offline Ventures, the lead investor in Arkive’s round, in a statement to TechCrunch. “In this economy, alternatives are showing better returns than the rest of the market and we believe that Arkive’s model presents a new way to appreciate how things of value are becoming sources of value.”