Bad news about smartphone shipments has become the norm, rather than the exception, in recent years. The trend pre-dates the pandemic, but has only accelerated during the pandemic, thanks to various economic and supply chain impacts. Even so, a high single-digit drop warrants examination and some difficult questions around the industry’s health.

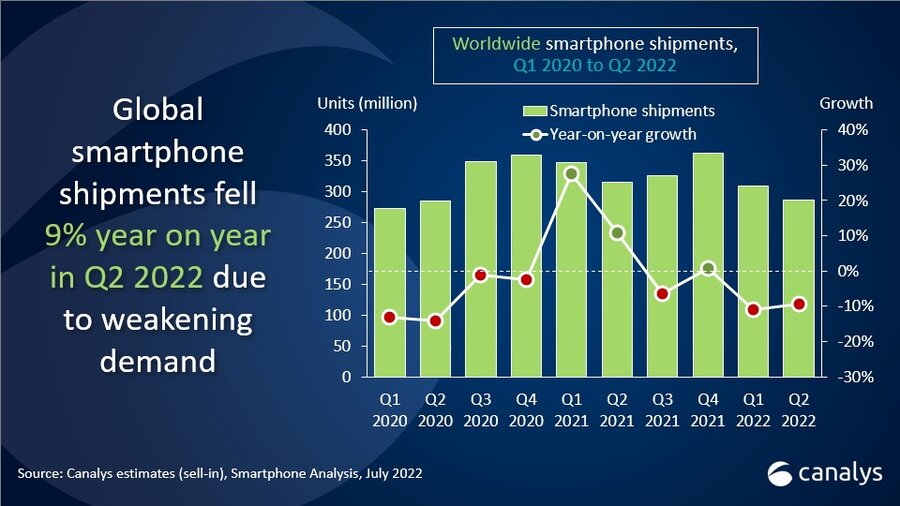

New figures out this morning from Canalys show a 9% year-over-year drop for global smartphone shipments in Q2. The culprits are, well, pretty much everything you’ve been hearing about for the last couple of years.

Says analyst Runar Bjørhovde:

Vendors were forced to review their tactics in Q2 as the outlook for the smartphone market became more cautious. Economic headwinds, sluggish demand and inventory pileup have resulted in vendors rapidly reassessing their portfolio strategies for the rest of 2022. The oversupplied mid-range is an exposed segment for vendors to focus on adjusting new launches, as budget-constrained consumers shift their device purchases toward the lower end.

Image Credits: Canalys

Consumers have broadly slowed down their upgrade cycles, as phones have gotten better and more robust. The phones themselves have grown more expensive in the process, adding an air of consumer caution amid economic uncertainty, including unemployment and inflation. Add to that chip shortages and supply chain bottlenecks, and you’ve got a recipe for an industry that has crashed back down to earth.

Given all of the above, it ought to come as little surprise that low-end and mid-tier devices have been driving what purchases remain. Most notable is Samsung’s A-series, which helped the company retain the top spot and grow its overall market share from 18 to 21%. Apple and Xiaomi effectively swapped market shares with 17 and 14% this quarter, as Apple took second place, propelled by demand for the iPhone 13.

Along with Xiaomi, fellow Chinese handset makers Oppo and Vivo also experienced market share drops for the quarter, at 1% apiece.