Financial projections are essential for any business, but in the case of tech startups, a financial model is one of the most important and overlooked tools available to a founder.

Venture-backed startups work on risky, aggressive capital deployment, often operating at a loss for years as they pursue expansion and market dominance. This means that runway is a critical KPI that founders need to keep an eye on for every single financial decision.

Aggressive spending should translate into aggressive growth: revenue might jump 20% or 30% month-over-month, which makes runway estimation an ever-moving target. Being able to expand the team a month earlier can make a tremendous difference in the long run, or cutting down expenses quickly can save the company from running out of money.

When milestones and deadlines are directly driven by your finances, you put yourself in a great position to iterate.

However, few founders build themselves the tools to help make those decisions. We connect with hundreds of founders every month, and the most common mistakes we see include:

- They created a financial model only to satisfy investors, but don’t use it for their day-to-day operations.

- They are using a revenue-driven financial model, rather than a driver-based model.

In the fast-paced world of startups, quick and educated decisions are critical. Take a look at this example scenario.

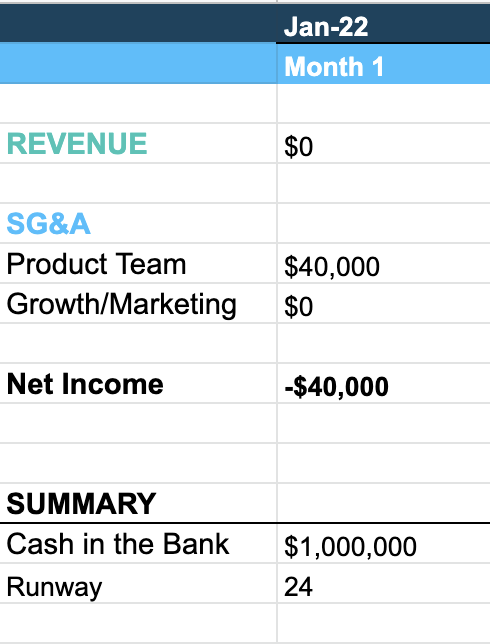

A company is looking to raise a $1 million seed round to finish building and launching its product. It can set a burn rate target of $40,000/month so that the capital lasts roughly 24 months.

Image Credits: Jose Cayasso

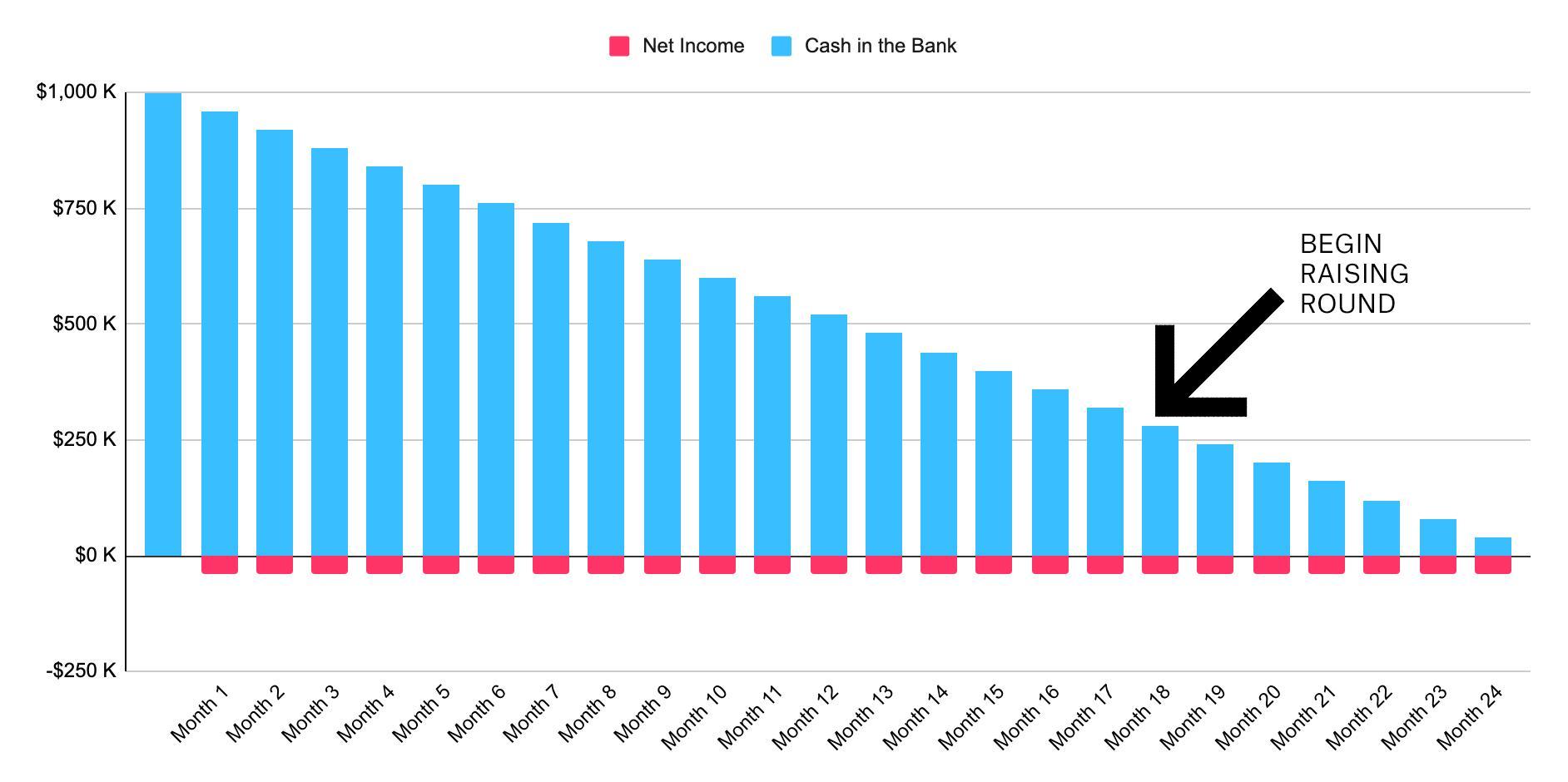

A safe cushion is to assume that new investor negotiations will take about six months, so by month 18, the company should be in a position to begin pitching to the next round of investors.

Image Credits: Jose Cayasso

Where does the company need to be when it wants to raise money? How much of the product should be ready? How much revenue will it have? How many customers? How much will it cost to bring those customers?

The founders need to make sure their capital deployment takes all of those variables into account. A miscalculation can translate into spending too little (and failing to launch the product on time), or spending too much (and not being able to close the next round before money runs out). The stakes are high.

The problem is, in my experience, seed-stage founders are rarely thinking of these targets when they define how much money they want to raise, or how they want to spend it.

Creating a model that you actually use

The most common problem I see is entrepreneurs think of the financial model as “homework,” so they prepare it to satisfy an investor request or to fill a slide in the pitch deck.

At the pre-seed or seed stage, it’s impossible for the model to predict revenue accurately. So for an early-stage company, the model should serve two main purposes:

- Oversight of the runway and letting you make financial decisions to ensure you reach your next funding milestone.