PayPal and Venmo are increasing their instant transfer fees for both consumers and merchants in the United States in the coming weeks, PayPal announced on Thursday. Instant transfers allow customers to transfer their money instantly to a bank account or debit card for a fee.

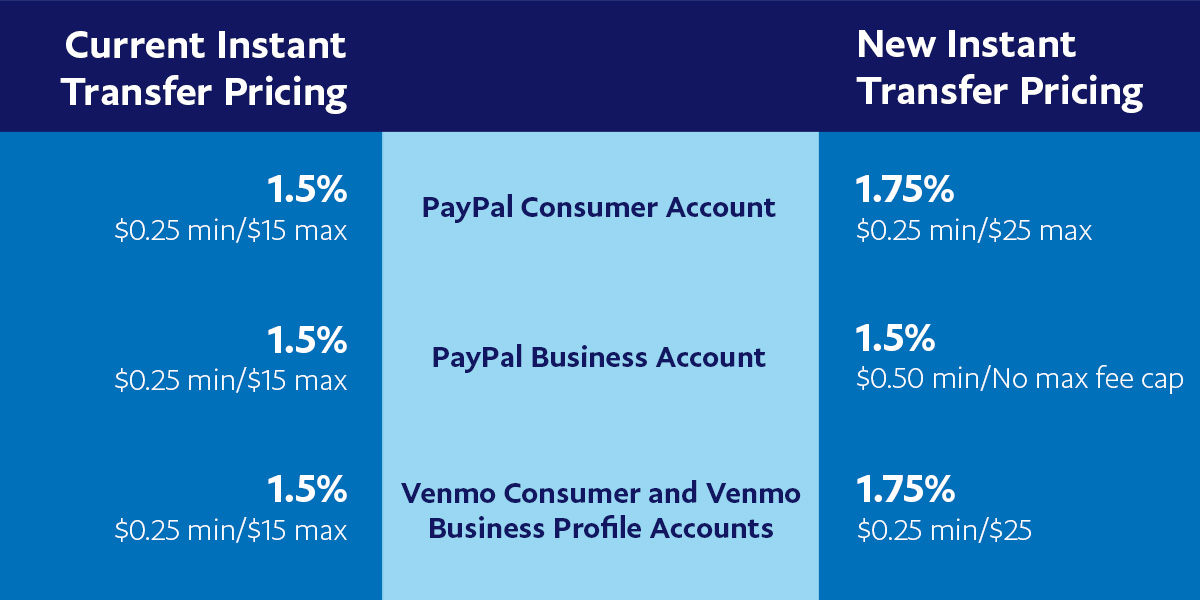

For personal accounts on PayPal and consumer and business profiles on Venmo, users will pay 1.75% of the transfer amount, with a minimum fee of $0.25 and a maximum fee of $25. Prior to this change, the instant transfer pricing for personal accounts on PayPal and consumer and business profiles on Venmo was 1.5% of the transfer amount, with a minimum fee of $0.25 and a maximum fee of $15.

Image Credits: PayPal

For PayPal merchant accounts, the company is maintaining the existing rate of 1.5% of the transfer amount, changing the minimum fee to $0.50 from $0.25, and removing the existing $15 cap in place of a new no-maximum-fee cap structure.

The new pricing change will go in effect on May 23 for Venmo customers and on June 17 for PayPal customers. In a blog post about the announcement, PayPal said it’s making the price changes “to be more in line with the value we provide.”

For people using PayPal and Venmo as a way to process big payments quickly or get some much needed cash into their accounts, the new changes will result in more getting scraped away by fees. The standard bank transfer feature on PayPal and Venmo is still free, but typically arrives 1-3 business days after you request the transfer.

PayPal and Venmo first announced their instant transfer features back in 2017. Although PayPal had been operating in the peer-to-peer payments business for nearly two decades, the company had been challenged by a number of newcomers whose key advantage had been the ability to “cash out” to your bank account instantly, leading PayPal to implement its own version of the feature.