Only 21% of the 12 million registered vehicles on Nigerian roads have genuine motor insurance, as the rest either have fake certificates (owners are mostly unaware) or are not covered at all.

This report also states that a number of car owners holding genuine insurance policies also fail to renew them when they expire, a contravention of the law in Nigeria, which demands that every vehicle must be covered by insurance. All these challenges stem from the fact that most transactions in the industry are still done manually and, most often, through agents, which further exacerbates the problems.

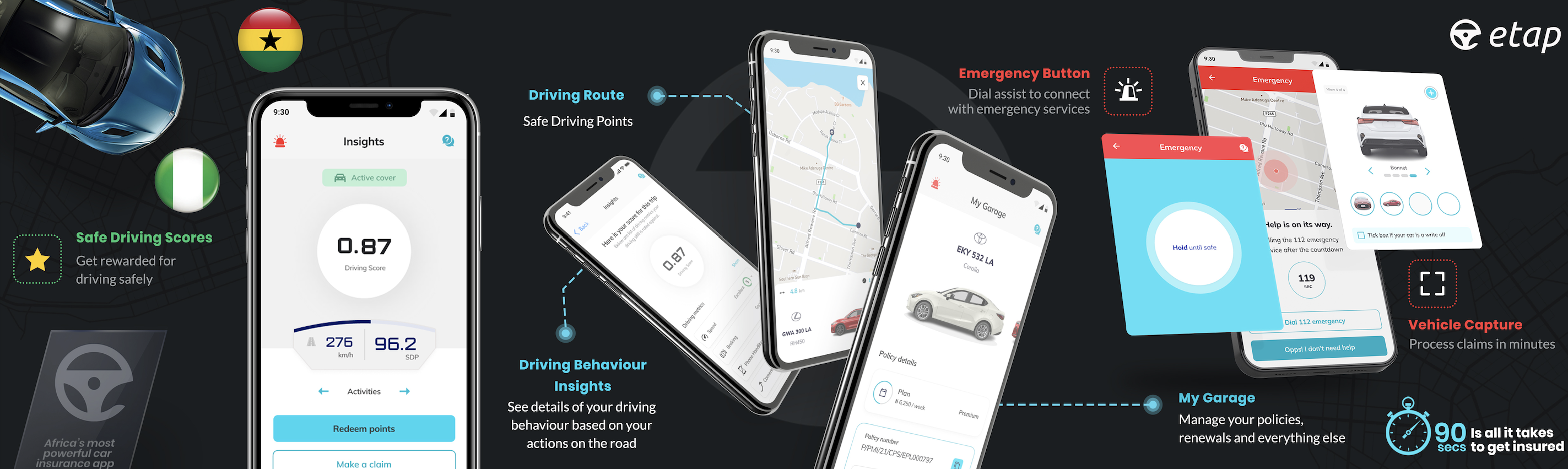

To bridge the gap, insurtechs like Etap have over the last few years emerged in Nigeria, and across Africa, to smoothen the process of buying insurance and making claims. Etap claim to enable motor vehicle owners to purchase insurance in 90 seconds and complete claims in three minutes.

The startup is now on an expansion drive across the West African country following a $1.5 million pre-seed funding in a round led by Mobility 54; the venture capital arm of Toyota Tsusho and CFAO Group.

“We have great products and excellent value propositions. But we know that the products and value proposition can be greater and that’s why we sought out partners that we have right now. Our plan is to have the most preferred insurance products and to grow and scale this across Africa. I feel like we are perfectly positioned to achieve that,” Etap founder and CEO Ibraheem Babalola told TechCrunch.

Tangerine Insurance also Etap’s underwriter, Graph Ventures, Newmont and several other angel investors participated in the round.

Etap claim to enable motor vehicle owners to purchase insurance in 90 seconds and complete claims in three minutes. Image Credits: Etap

Babalola started building Etap last year frustrated by the complexities and delays involved in purchasing insurance. In his own words, he set out to make buying insurance and making claims as easy as taking a picture – hence the name Etap.

“The idea itself is from being a frustrated customer; my insurance would expire and I wouldn’t get a notification to renew it…I always had to make a call to a guy who would help me renew it. I thought that there is a way to do it better,” said Babalola, adding that policyholders receive notifications when their coverage expires, and can also opt for automatic renewal.

Babalola, who has experience building and helping financial services and proptech startups to scale, previously worked with an executive of a top insurance company in Nigeria, which sparking his interest in the sector.

“Nigeria has one of the highest risk environments in the world and an insurance penetration of less than 2% — that relationship is crazy because the higher the risk the more the propensity to want to protect yourself against events; but in Nigeria and the rest of Africa, this is not the case. This needs to change,” said Babalola.

He added that, “Having all these experiences from being on the two sides; being a customer and close to the operator, and experience in building startups; I thought it’s important to reimagine insurance — To reimagine the offering, how people access it, user experience — to make it more flexible, and transparency — by building trust and giving people more value.”

The startup launched the beta version of its app in November last year, enabling people to buy insurance according to their needs; per trip, daily, monthly or yearly. Yet making the process easier and flexible is not the only driving force behind Etap’s growth; the startup also tailors the price of its products according to driver behavior. They’ve also gamified the products too, as customers earn and redeem points based on their history.

“With our retail distribution, you get profiled based on a bunch of data points that place you in a risk class,” he said.

The startup’s end-to-end services also include pre-loss inspection (done when signing up) and post-accident reviews, all of which is based on images. To prevent fraudulent claims, the app comes with geolocation tags, timestamps and other features like crash notification.

Mobility 54’s project manager, Yumi Takagi said, “Etap is addressing many challenges that impact the automotive experience in Africa, and we are excited to support and work with them to bring their innovation to more drivers across the continent. We believe that ETAP will engage with this important role and revolutionize the automotive insurance industry with their powerful technology.”