Why is venture funding so confusing? Isn’t the formula simple?

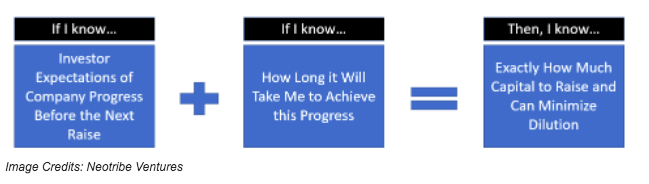

Well, to start, the presumption that a company knows what its investors expect with full clarity is a lofty one. Investors will have both financial and non-financial milestones they expect a company to achieve between raises, and these milestones can differ greatly between stages.

Even with this information, it can be difficult to project how long it will take to achieve these goals. Finally, is it even correct to assume that minimizing dilution is the singular goal?

With the caveat that every company journey, fundraising environment and investor preference is different, let’s put aside all of the truths we think we know and start at the beginning:

In all likelihood, the first question a founder must answer is how much money to raise. This question considers a lot of inputs, but the three that are the most opaque to founders are:

Capital is dramatically more expensive at the early stages because there are major risks involved and the probability of a successful outcome is low.

- How expensive is venture capital (as defined by the amount of dilution)?

- What financial milestones will investors expect me to reach between each raise?

- What are the more subjective milestones I need to hit to evidence I’m ready for the next raise?

Let’s take these questions one at a time.

How expensive is venture capital?

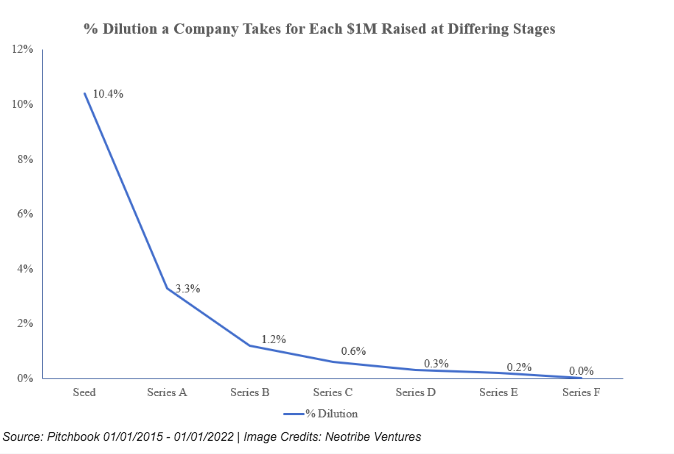

Before we address the inputs in the equation, we need to understand if the output — minimizing dilution — is exactly what we should solve for during each raise. To do this, let’s look at the median amount of dilution companies have taken at each stage over the last several years. To put it into useful context, let’s look at dilution for each $1 million raised.

This graph shows us that for every $1 million raised in a seed round, it costs ~10% of the company. By Series B, the dilution per $1 million falls to ~1.2%, and by Series E, each $1 million of capital raised costs ~0.2%.

In other words, the cost of capital dramatically decreases as a company grows. This deep decline in the cost of funding at progressive fundraises is what I like to call the Venture Capital Price Curve.

Does the Venture Capital Price Curve prove that the singular goal of a company fundraise should be to minimize dilution? Not quite.