PassiveLogic, a startup developing a platform to autonomously control building systems, today announced that it raised $15 million from Brookfield Growth, the investment arm of asset management firm Brookfield. CEO Troy Harvey says that the new capital will be put toward growing PassiveLogic’s team and “launching an ecosystem of products that enable autonomy.”

Analysts at McKinsey (among others) predict the pandemic will spur an interest in more comfortable, sustainable working spaces. But assuming that comes to pass, legacy industrial building controls threaten to make such projects daunting. According to market research agency ARC Advisory Group, there are roughly $65 billion worth of distributed building control systems nearing their end of life, with many of those systems over 25 years old.

“Right now, building controls utilize very limited information to make sure the building works accordingly,” Harvey told TechCrunch via email. “To get to the future of real estate, there needs to be a digital platform that can aggregate building data, [allowing] building managers to customize automation controls and act upon it in real-time.”

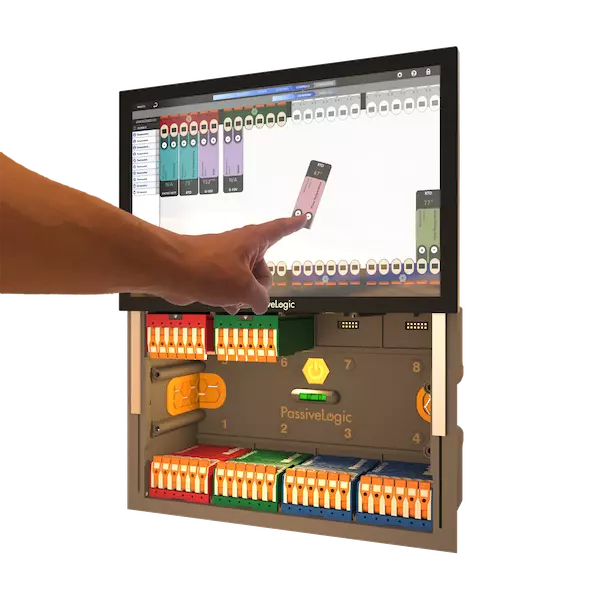

PassiveLogic provides this solution, Harvey claims, built around what he calls the “Hive” controller. PassiveLogic’s product is designed to enable autonomous control of legacy building systems by interfacing with them using a combination of sensors, equipment, and devices that don’t need cloud connectivity.

Harvey founded Salt Lake City, Utah-based PassiveLogic in 2016 with Jeremy Fillingim. Harvey was previously the CEO of Heliocentric, an engineering firm that worked with clients to architect “next-generation” buildings. Fillingim was a partner at Mote Systems, where he designed a touchscreen universal remote control.

PassiveLogic’s Hive controller.

PassiveLogic hosts a software environment, Autonomy Studio, where customers can create building system models from CAD or 3D models. The software uses these models to generate a “physics-based digital twin” in a descriptive language called Quantum. Applications written in Quantum can be deployed within PassiveLogic’s control hardware — the aforementioned Hive.

Harvey asserts that Quantum provides “virtual analogs” to real-world objects via algorithms that attempt to understand how a building’s equipment and systems interact. Based on these predictions, PassiveLogic makes control and management decisions for maintenance and operation.

“PassiveLogic is creating [a] platform for generalized autonomy. The aim is to empower anyone to effortlessly design their own custom applications — without requiring a team of Ph.D.s,” Harvey said. “[There’s] no programming required to understand how a building’s equipment and systems interact.”

Digital twin technologies, which digitally models real-world systems, aren’t new. GE, AWS, and other companies offer products that allow customers to model digital twins of machines. London-based SenSat creates digital twin models of locations for construction, mining, and energy projects. Meanwhile, startups like Lacuna and Nexar are building digital twins of entire cities.

But digital twin technologies share the same limitations, chief among them inaccurate modeling in the presence of inaccurate data. Indeed, the models are only as good as the data that’s used to develop them. As Gartner notes in a report: “It is difficult to anticipate the nature of the simulation models, data types, and data analysis of sensor data that might be necessary to support the design, introduction, and service life of the digital twins’ physical counterparts. While 3D geometry is sufficient to communicate the digital twin visually and how parts fit together, the geometric model may not be able to perform simulations of the behavior of the physical counterpart in use or operation. At the same time, the geometric model may not be able to analyze data if it is not enriched with additional information.”

Image Credits: PassiveLogic

Another potential pitfall is the proprietary nature of digital twin platforms. Digital twins with long life cycles, like those of building systems, might extend well beyond the lifespans of the software and hardware used to create and maintain them.

Harvey says that PassiveLogic’s Hive hardware is engineered to combat data inaccuracy, and he challenges the idea that PassiveLogic will ever leave its customers without the necessary software updates.

“PassiveLogic’s generalized autonomy platform is ideally suited to buildings, which are complex control systems requiring entirely customizes solutions. (Buildings represent our largest single use case). However, the technology will have an equal impact on other complex systems like energy grids, logistics and supply chain facilities, networks, and other critical infrastructure,” he said. “We’re fortunate to work with forward-looking investors, who understand that backing real technology to solve real market problems takes time.”

Brookfield managing partner Josh Raffaelli added: “To get to the future of real estate, there needs to be a digital platform that can aggregate building data, enable building managers to customize automation controls, and act upon it in real-time. This platform will be the interface for the next generation of PropTech services the market wants to plug into buildings, and will save customers both time and money in deploying automation projects.”

PassiveLogic — whose total capital raised stands at $68.2 million with the new funds — remains in the pre-product stage, with plans to enter beta and production later this year. The company currently has a workforce of between 70 and 80 employees and expects to grow to 140 by the end of the year.

“PassiveLogic is building the next generation of AI technology and attracting the best and brightest from all fields to address this opportunity for impact,” Harvey said. “In recent pilot projects, PassiveLogic’s approach demonstrated … energy savings and … labor savings in programming, installation, and commissioning compared to conventional solutions.”