American Express has launched its first all-digital consumer checking account, the company announced on Tuesday. The new offering, American Express Rewards Checking, is currently available for eligible U.S. Consumer Card Members. The launch comes as the emergence of digital banking services is causing traditional banks to enhance their digital strategies and offer more competitive banking offerings.

American Express says the new account offers Membership Rewards points for eligible debit card purchases, an annual percentage yield rate that is 10 times higher than the national rate and purchase protection for eligible purchases. The new offering also doesn’t have monthly maintenance fees or minimum balance fees. Amex Rewards Checking features a 0.50% APY and comes with a debit card that earns members one Membership Rewards point for every $2 spent on eligible purchases, which can be redeemed for deposits into customers’ Amex Rewards Checking accounts. Members can also access and manage their checking accounts on the American Express app and can deposit checks via the app.

“Our Members want more banking products and services from us,” said Eva Reda, the executive vice president and general manager of consumer banking at American Express, in a statement. “And they want more from their checking account, without giving up the benefits that are important to them. That’s why we built Amex Rewards Checking to deliver more value for Members with the powerful and trusted backing of American Express. It’s digital checking without compromises.”

The account also comes with fraud protection and monitoring, along with access to customer service via phone or chat. The new checking offering adds to the company’s existing consumer deposits products, including the American Express Savings account (HYSA) and Certificate of Deposits (CDs).

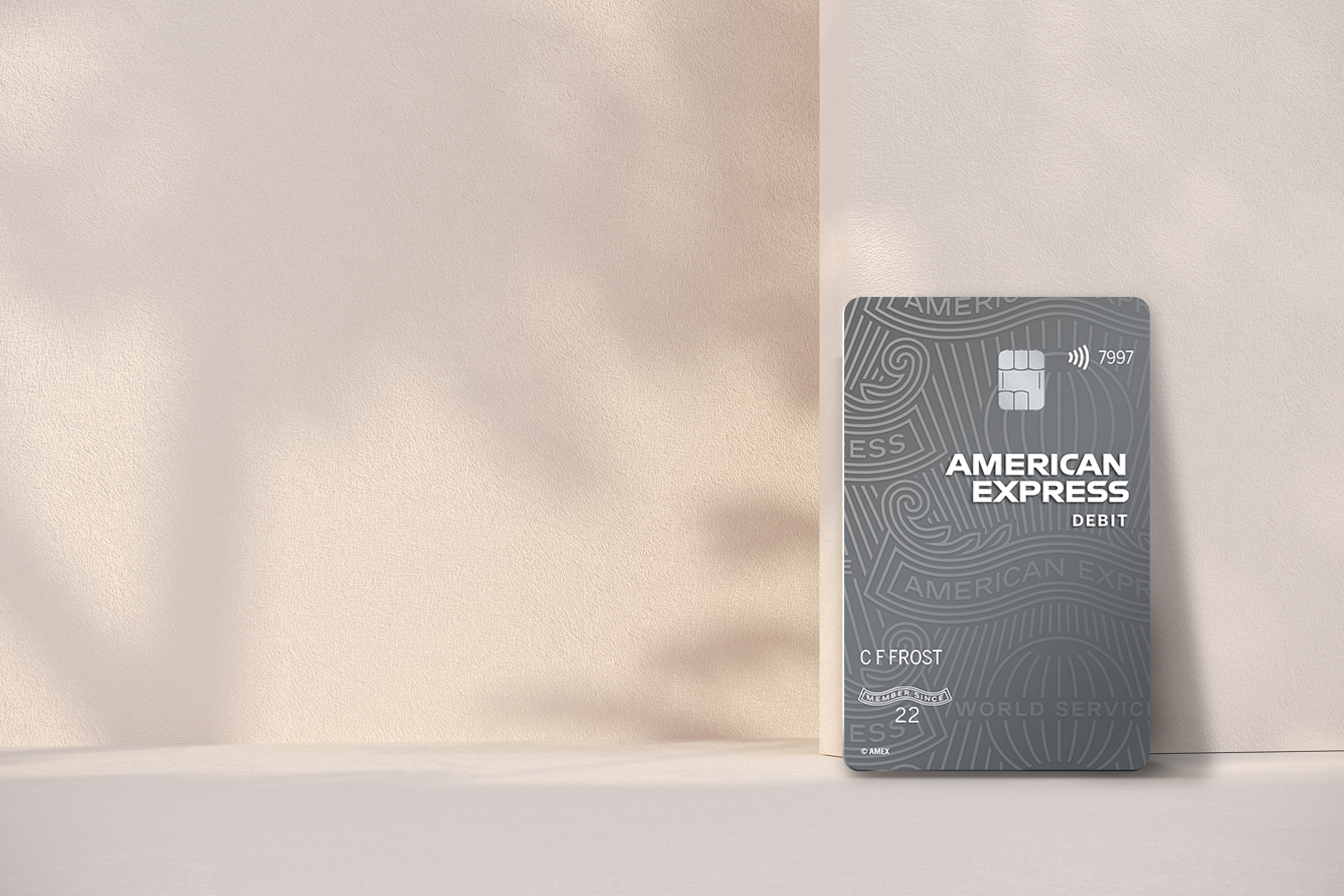

Image Credits: American Express

Digital banking is evolving the traditional banking sector due to the rise in demand for digital services and the increasing popularity of new startups and neobanks. Startups like Varo Bank, Chime, Current and many others are disrupting the traditional banking sector and causing financial companies, like American Express, to launch more offerings to attract and retain members.

Today’s announcement follows the company’s plans to partner with Opy, the U.S. subsidiary of Australian fintech Openpay, to allow all of its U.S. cardmembers to pay in installments for qualifying purchases in the healthcare and automotive segments. American Express already offers its own BNPL options under its “Pay it Plan it” program launched in 2017 for purchases above $100, which also offers a fixed interest rate. The Opy partnership will help Amex meet the demand for options to finance large purchases over longer periods of time.

Last July, American Express also tapped startup BodesWell to branch out into financial planning. The credit card giant launched a pilot of its first self-service digital financial planning tool, dubbed “My Financial Plan (MFP).” The product is designed to give users a complete picture of their financial health and help them make and achieve major life goals, such as buying a house or retirement.