Justworks released an updated IPO filing today, providing fresh financial results and a look at what the company may be worth when it debuts.

For those of you in search of a single number, using a simple share count, Justworks could be worth more than $2 billion at the top end of its current range.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

But that’s hardly enough information. So this morning, The Exchange is going to calculate the company’s various simple and fully diluted valuation marks, run multiples using its most recent quarter’s results, and compare all the data to the firm’s final known private valuation.

I had wanted to write up a 2022 IPO primer this morning, discussing the upcoming Reddit and Via IPOs, but that will have to wait a day. The Justworks S-1/A filing is here, if you want to follow along. Let’s talk SMB-focused HR software!

I had wanted to write up a 2022 IPO primer this morning, discussing the upcoming Reddit and Via IPOs, but that will have to wait a day. The Justworks S-1/A filing is here, if you want to follow along. Let’s talk SMB-focused HR software!

Justworks’ recent financial performance

If you missed our first look into the Justworks story, let’s catch you up: The company has two core business lines. The first, called subscription, is what Justworks charges for access to its service — things like “HR expertise, employment and benefit law compliance services, and other HR-related services,” per its filing.

The other, larger component of its top line is called “benefits and insurance-related revenue.” The former is pretty high margin, the latter less so.

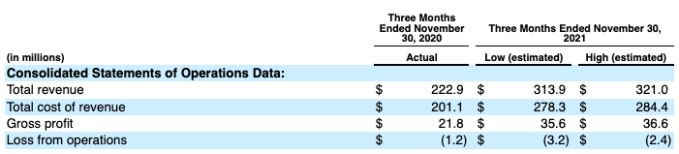

Here’s how the company did on an aggregated basis in its November 31, 2021, quarter:

Image Credits: Justworks S-1/A filing

As you can see, Justworks posted fairly material growth on a year-over-year basis, and even better gains in terms of gross profit. If you are surprised that the company’s resulting gross profit is so small compared to its revenues, recall that Justworks is not merely a software company; its revenues include lots of that lower-margin “benefits and insurance-related revenue” that we noted above.

More simply, the company is in the SMB HR space, so its software unlocks customer activity that will not generate SaaS-like margins. Still, the company’s aggregate results detail growth and very limited losses. So we can note that the company’s revenue mix is different from what we see from most software companies while also not being rude about that fact.