The “last mile” in the supply chain has gotten lots of attention during the pandemic. Even ecommerce giants like Amazon have struggled to surmount the challenges of distributing product fast enough to keep up with demand.

But Factor, a startup created in 2018 by manufacturing industry veterans Doug Shultz and Michael Szewczyk, just raised a seed round to streamline a different part of the supply chain process, which it calls the “first mile.” For Factor’s 250+ customers, mostly manufacturing companies, the “first mile” consists of processes like ordering raw materials, choosing the ideal supplier for each order, and paying them on time, Factor CEO Shultz told TechCrunch in an interview.

“Most people look at the supply chain and they think about the shipping containers stuck in LA or the boats outside the port of Long Beach. The exciting thing for us is the problems that we’re solving more upstream in the chain can really help companies avoid getting in those types of bottlenecks in the first place,” Shultz said.

The ventilator shortage at the beginning of the COVID-19 pandemic resulted from inefficiencies in the “first mile” of manufacturing, Shultz said. It took six months for supply to meet demand in that scenario because of “manual and tedious” standard practices across the industry, he added.

“What caused it to take six months, even with Elon Musk and Tim Cook personally involved, was that inside of that process, there are 700 components that are coming from 200 first-tier suppliers, and then hundreds more underneath that first tier. If you think about how companies order stuff and pay each of these suppliers when there are literally thousands of different moving parts, that’s what takes six months,” Shultz said.

Factor cofounders Doug Shultz and Michael Szewczyk Image Credits: Factor

Factor’s product helps companies manage transaction infrastructure throughout the “first mile” by leveraging artificial intelligence to automate core supply chain processes. It provides payment tools, data to aid in supplier selection, and order tracking and execution features to its customers, who tend to make complex products for industrial use in areas like robotics, medical devices, and aerospace and defense, Shultz said.

Companies using Factor bring their own suppliers onto the platform, and Factor helps them measure data about each supplier’s outcomes – for example, how many times a supplier has delivered goods to them on time. Factor is “less so a marketplace, more so an infrastructure to help you make decisions,” Shultz said.

Companies that don’t use Factor typically use manual tools like spreadsheets to manage their “first mile” processes. Others use enterprise resource planning (ERP) software through providers like Oracle and SAP, which is more easily customizable but oftentimes prohibitively expensive for mid-size and small companies to use, Shultz continued.

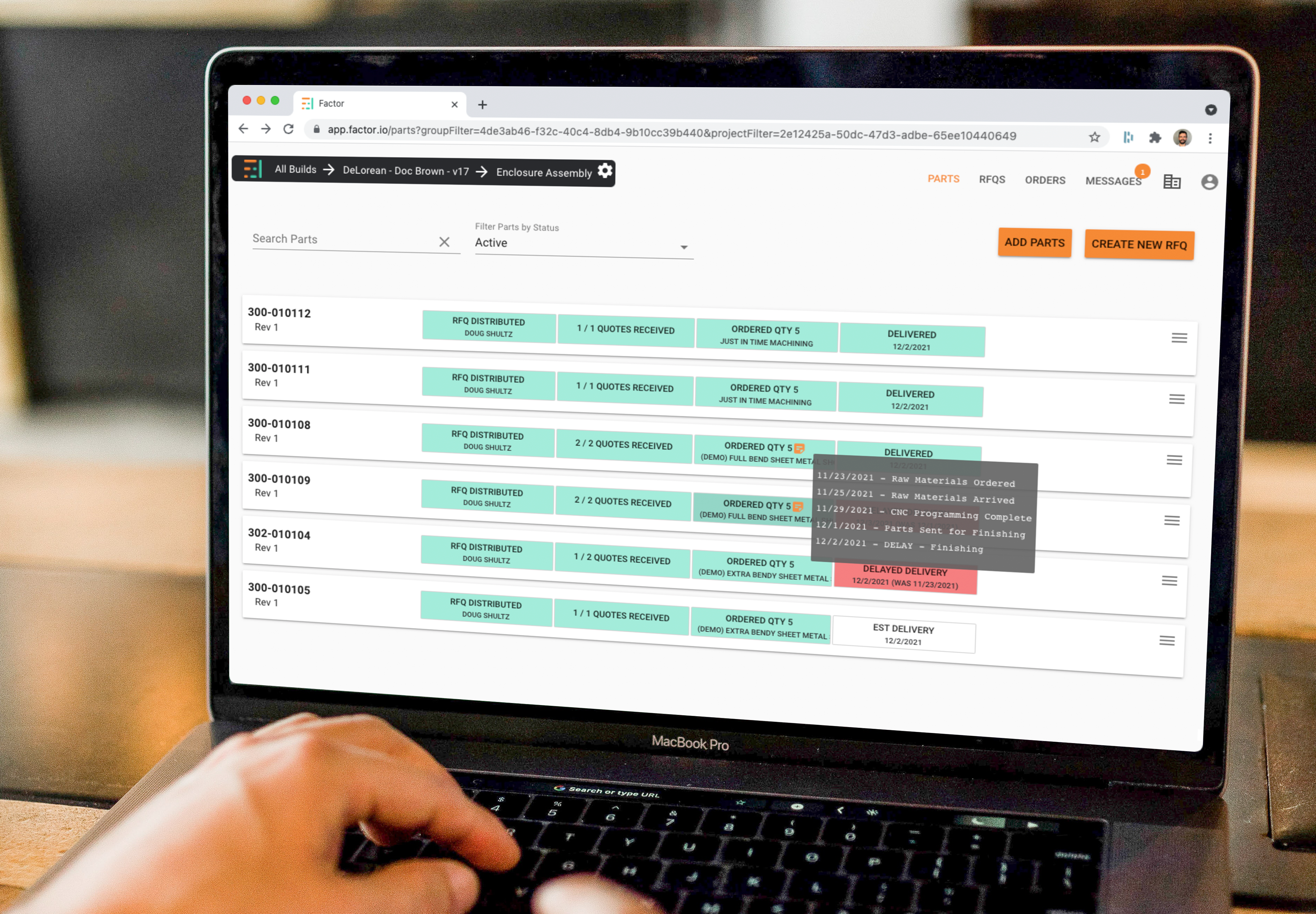

Factor’s parts status tracking feature Image Credits: Factor

Factor hopes to provide a more reasonably priced supplier management service for these sorts of companies, but it also sees its payment features as key differentiators from other ERPs.

The manufacturing industry accounts for over 20% of B2B payments globally, Shultz said, but many of the largest companies in the industry are still transferring vast amounts of money through paper checks. Factor’s platform offers automated payment features built on top of infrastructure from payment processors like Stripe.

“We’re layering on top of that infrastructure applications that can essentially coordinate where the payments are going, and also provide additional value. We have all this data about your order history or suppliers, and we can now pull in the financial services on top of that,” Shultz said.

The company, which has seen customer order volume grow 10x in the past nine months, announced today it had raised $6 million in seed funding to grow its platform. Google’s AI-focused fund, Gradient Ventures, led the round alongside other investors Xfund, Afore, and South Park Commons.

It plans to use the capital to further develop its financial services capabilities by adding new banking partners and offering financing products, Shultz said. It is currently working with a credit provider to develop a credit functionality for companies to fund their short-term working capital needs, he added, though he declined to name the credit provider.

Shultz, who hired Factor’s first head of sales a few weeks ago, said he was excited to receive backing from Darian Shirazi at Gradient Ventures because of Shirazi’s big-picture view of the company’s growth potential.

Shirazi understood that “buyers are always suppliers, suppliers are our buyers, and we can turn on this viral engine to [become] the base transaction layer for all of manufacturing,” Shultz said.