Usage-based pricing (UBP) has quickly gone from fringe to mainstream in SaaS. Converts to UBP are drawn to the promise of accelerated revenue growth and a more efficient land-and-expand business model.

But achieving faster revenue growth isn’t as simple as just changing pricing. UBP is a company-wide effort and requires ditching the old SaaS metrics playbook.

One way to think about usage-based revenue is that it’s product-led growth (PLG) in its purest form.

Consider Snowflake, a data warehousing company that went public in 2020 and now has a $100 billion market cap. While conventional wisdom suggests SaaS companies should aspire for net retention of 100% or greater, Snowflake reports an off-the-charts 169% net retention driven by an effective consumption-based pricing model. The company’s net retention actually rose from 158% in Q2 of fiscal 2021.

For Snowflake, $1,000 in initial spend from a new customer would theoretically turn into $13,000+ after five years. So how much should I spend on customer acquisition (CAC) to acquire a new logo? Do I compensate sales for the initial spend, or should reps share in that customer growth? How should I invest in product and engineering to ensure customers see better value as their costs increase?

Many usage-based companies ask themselves similar questions.

Usage-based companies share their customers’ success

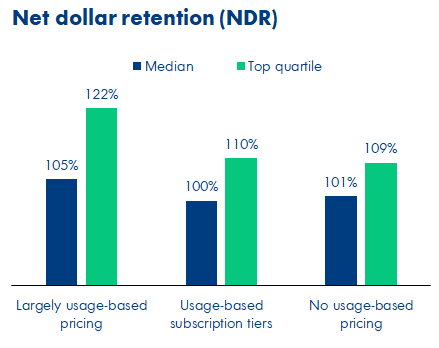

Leading usage-based companies have the phenomenal ability to grow with their existing customers at extremely high rates. Top-quartile net retention for those with a largely usage-based pricing model was 122% compared to those with usage-based subscription tiers (110%) or no usage-based pricing (109%), according to OpenView data.

Image Credits: OpenView Partners

But such an expansion isn’t usually a result of selling more products or gating advanced features behind up-sell packages. It comes from customers increasing their consumption as they become more successful and discover new use cases.

For example, Twilio boasts a 132% net retention rate across an impressive base of 200,000+ active customers, and about 85% of Twilio’s net expansion comes from usage with only 15% coming from new products, according to the company’s 2020 investor presentation.