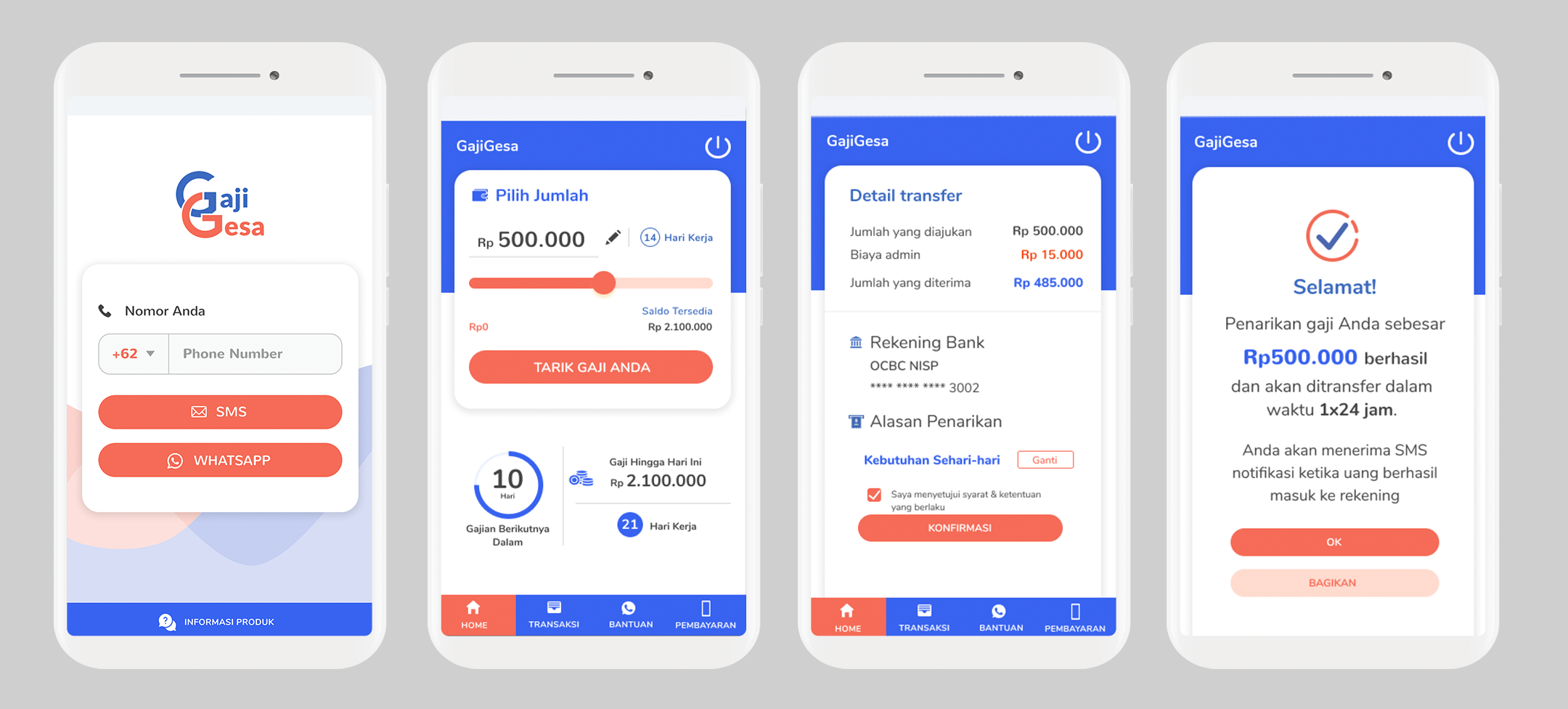

GajiGesa’s earned wage access feature user flow

GajiGesa, a fintech company focused on services for Indonesian workers, announced today that it has raised $6.6 million USD in pre-Series A funding. The round was led by MassMutual Ventures, with participation from January Capital, European earned wage access company Wagestream (EWA is GajiGesa’s flagship feature), Bunda Group, Smile Group, Oliver Jung, Northstar Group partners including Patrick Walujo, Nipun Mehra (the CEO of Ula) and Noah Pepper (Stripe’s head of APAC). Returning investors included defy.vc, Quest Ventures, GK Plug and Play and Next Billion Ventures.

For a more in-depth look at GajiGesa, take a look at TechCrunch’s profile of the company from February, when it raised its $2.5 million seed round.

Agrawal and Malinowska said in a press release that GajiGesa’s team has doubled in size over the past six months to over 50, and the startup plans to use its latest funding on product development, expansion across Indonesia and entering new markets in Southeast Asia.

The startup is aimed at unbanked workers and focuses on earned wage access, which lets people withdraw their wages immediately instead of waiting for monthly paychecks, because the founders—husband-and-wife team Vidit Agrawal and Martyna Malinowska—said that gives workers much more liquidity and protects them from predatory lenders.

GajiGesa now works with more than 120 companies in a wide range of sectors, including factories, plantations, manufacturing, retail, restaurants, hospitals and tech companies. Based on a survey of its clients, GajiGesa claims that over 80% of their employees have stopped using informal lenders because of its EWA feature and 40% are using other financial services through the platform like bill payments and data recharge.

The company offers an employer app called GajiTim, which it claims is Southeast Asia’s “first and largest integrated employee management solution.” By that, it means that employers can manage a wide array of workforce administrative tasks, including part-time and full-time employees and gig workers. The company says GajiTim currently has more than 200,000 users.

In a statement about the investment, MassMutual Ventures managing director Anvesh Ramineni said, “[GajiGesa’s] integrated platform combines customer-centric product design and world class technology infrastructure to ensure they are uniquely positioned to empower an chronically underserved market and help expand financial resilience for millions across Southeast Asia.