Of all the startup markets in the world, fintech in Latin America is one of the hottest. Capital is flowing into the region’s financial technology companies at a slicing pace, leading to a wave of startups that are building private-market value at a simply astounding rate.

The sheer volume of capital flowing into LatAm fintech startups may appear overheated, but several reasons explain why the flood makes sense. This isn’t to say that every deal and every resulting valuation markup is logical. But there are several factors in play that make the booming venture capital totals these companies are raising more reasonable than they might initially appear.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Regulatory tailwinds in select markets are helping build momentum for fintech products. Also, several startups — we’ll speak to Pomelo and Belvo below; Swap is another example — are working to build infrastructure that should help bring more financial services to market.

And finally, the Latin American fintech market is seeing exit volume pick up, not only implying that capital can be returned to investors who bid up the region’s startups, but also that funds previously preserved in private-market amber and recently made liquid can be reinvested in startups, creating a virtuous circle.

Let’s quickly chew on just how much more money fintech startups in Latin America are raising this year before turning to discuss the logic behind the influx.

A rising tide of capital

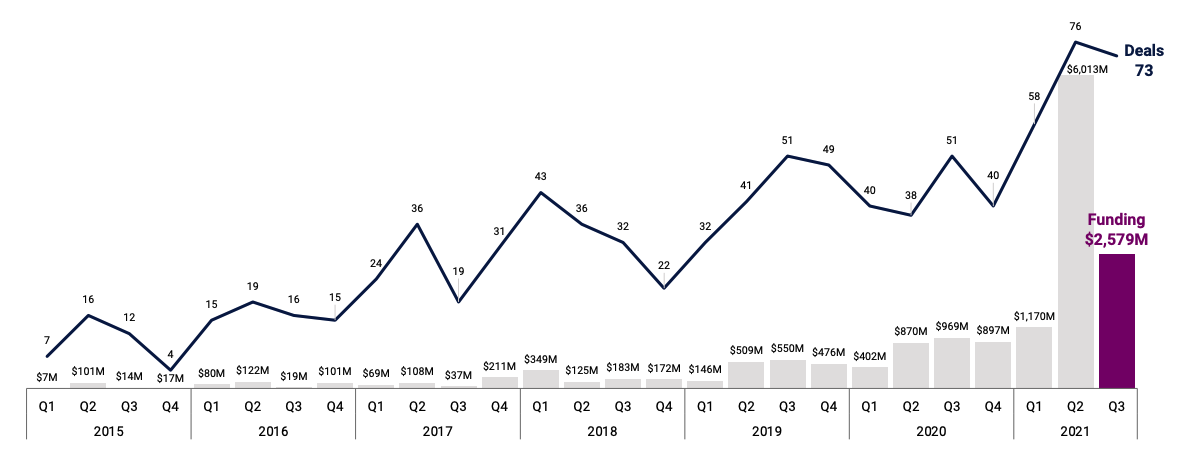

CB Insights data indicates that despite rapid growth from 2015 to 2020, when Latin American fintechs raised $138 million and $3.14 billion, respectively, 2021 stands apart from other years in terms of growth.

Image Credits: CB Insights

It’s proved somewhat common to see rising dollar volume for any particular venture capital market or startup category reach new highs in recent quarters. But we’ve seen such records come often with flat, or perhaps even lower deal volume. That is not the case with LatAm fintech; both dollars and deals in the region are going to smash through 2020 and 2019’s superlatives, and indeed have already done so.

The dollar result will wind up more impressive than the deal figure, but both are set to crush prior totals.

Narrowing our vision to quarter tallies over yearly and year-to-date results, Latin American fintech startups just had the second best quarter on record. The startup cohort’s Q3 2021 period was only beaten by Q2 2021; if we excise the second quarter, for reference, Q3 2021 itself is more than a double of any prior quarterly record.