Back in March, I wrote about how BoxedUp pivoted to enable high-end video production gear sharing and its $2.3 million seed round. At the time, the company’s founder David Boone stuck out, so when I started the pitch deck teardowns, I knew I wanted to feature BoxedUp in one of the installments.

Today, we’re taking a close look at the pitch deck that helped Boone raise the company’s first round of institutional capital.

I am grateful to BoxedUp for sharing a completely unredacted deck with us — all the details the company used to raise the money are in there, so it is a particularly representative deck.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

- 1 — Cover slide

- 2 — Team highlights slide

- 3 — Business cycle slide

- 4 — Market size slide

- 5 — Problem slide 1

- 6 — Problem slide 2 (shows the price of equipment)

- 7 — Problem slide 3 (problem as experienced by equipment owners: under-utilized premium equipment)

- 8 — Problem slide 4 (problem as experienced by creators: poor rental options and high price)

- 9 — Solution slide

- 10 — Go-to-market strategy

- 11 — “Previous customers” slide

- 12 — Target audience slide

- 13 — Business model slide

- 14 — Traction slide

- 15 — Projection slide

- 16 — Competition slide

- 17 — Market size slide

- 18 — Cover slide (“Where BoxedUp is going”)

- 19 — Road map slide

- 20 — Team slide

- 21 — End slide

- 22 — Use of funds and fundraising progress slide

Three things to love

BoxedUp quickly demonstrates a deep understanding of the market it is in and makes a compelling case for why high-end video and audio equipment makes sense.

As the company outlines in its deck (slide 6), a full set of video equipment for a high-end shoot can cost $100,000 — about the same as a high-end luxury sedan. You wouldn’t buy a convertible for a weekend trip; you’d rent one, so there’s no reason you wouldn’t do that when shooting a music video either.

An excellent illustration of bottom-up market sizing

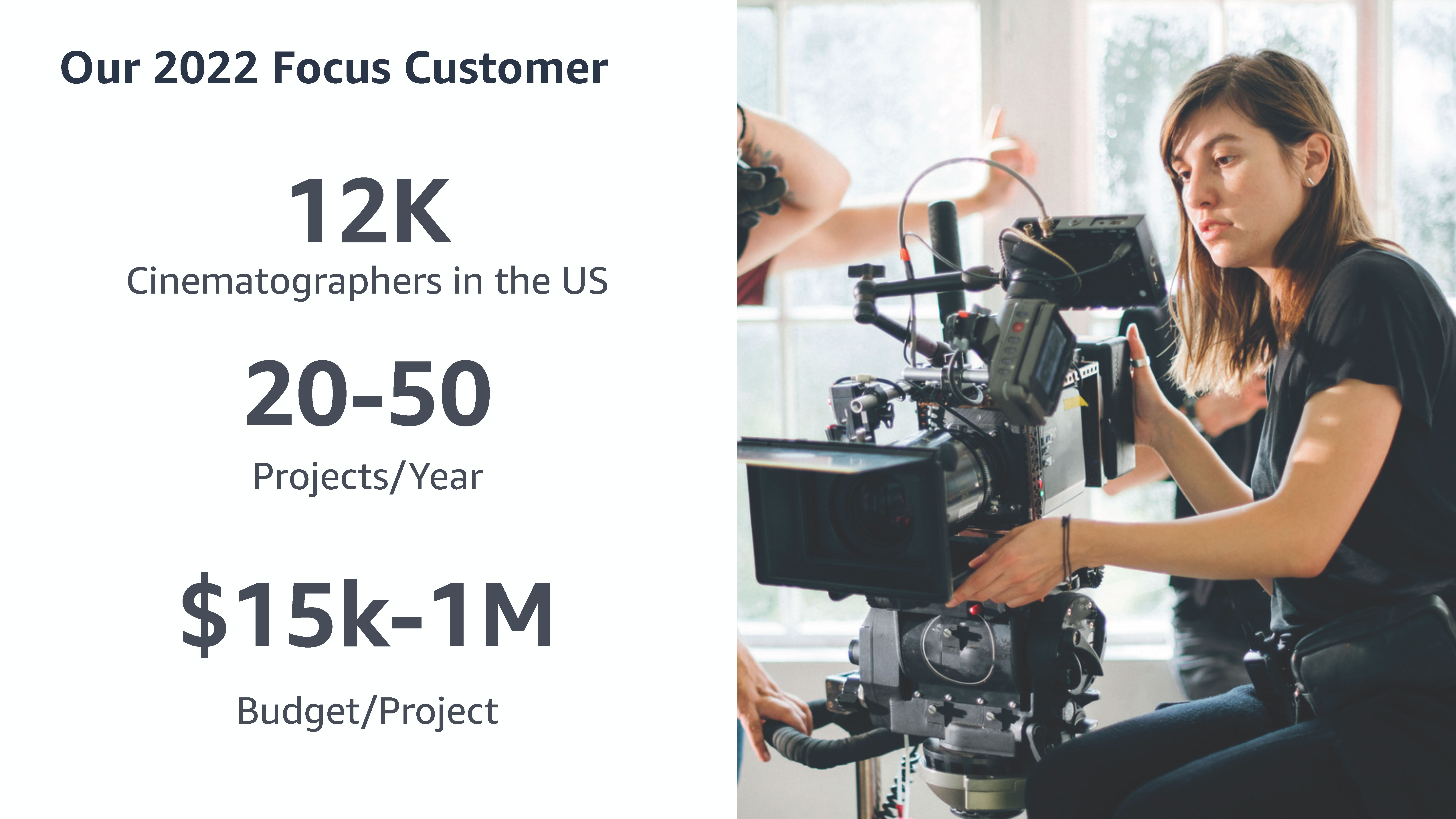

[Slide 12] BoxedUp makes the point that it has a huge beachhead market. Image Credits: BoxedUp.

On its 12th slide, the company is doing something really clever indeed — it outlines its beachhead audience. That is the first audience the company is planning to target with its marketing efforts. Without spelling it out, it shows that it has huge annual market potential (12,000 cinematographers running 20-50 projects per year at a $15,000-$1 million budget), with annual spend ranging from $3.6 billion at the low end to $600 billion at the high end.

We can talk about whether those numbers are realistic and what share BoxedUp is likely to grab of that budget, but it tells me one thing for sure: If the founder can defend those numbers in one market, they have a venture-scale business in their hands.

From startup to scale-up

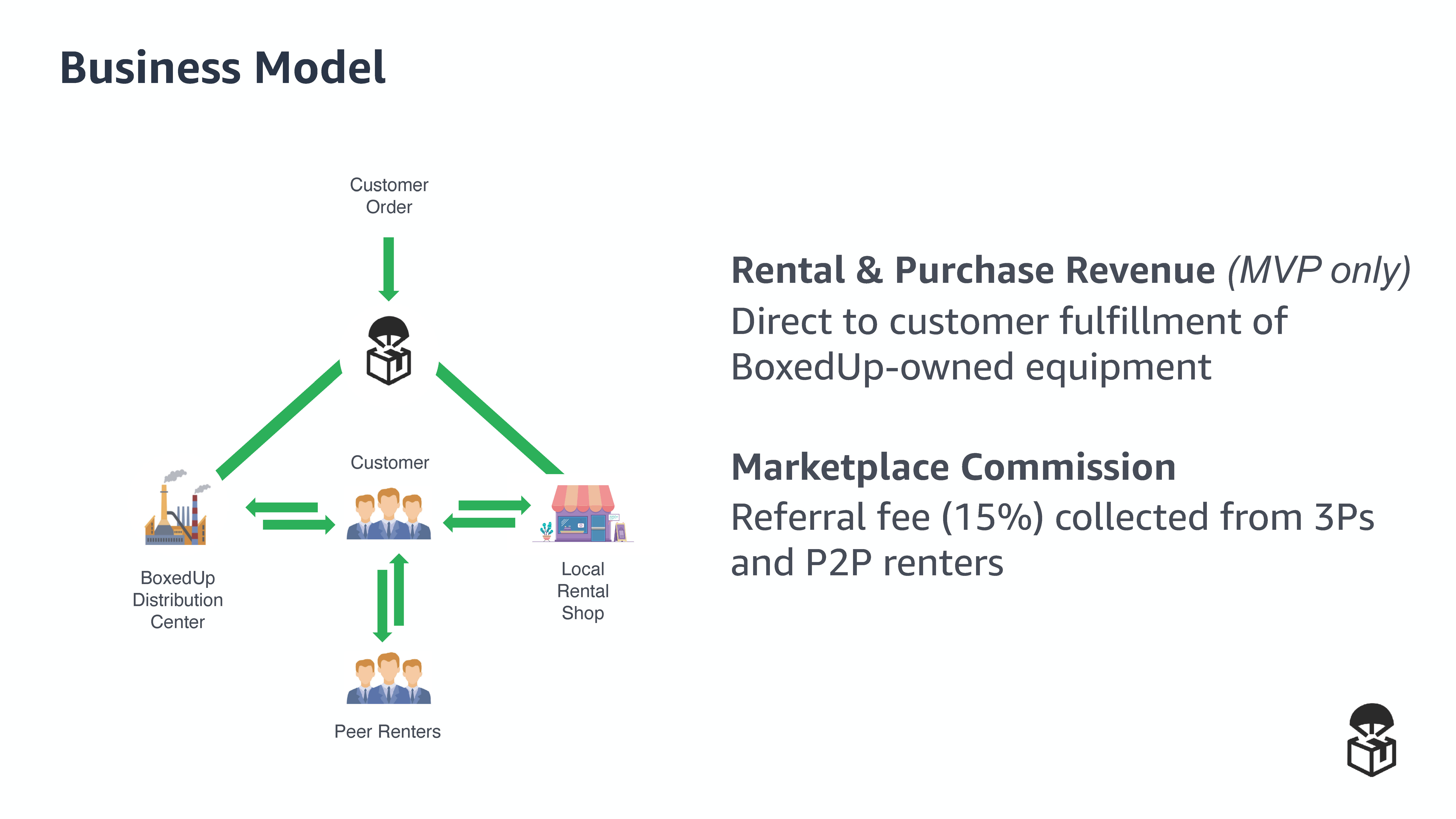

[Slide 13] Marketplaces are notoriously hard, but the company preempts hard questions by tackling the transition head-on. Image Credits: BoxedUp.

One of the really big challenges with marketplaces is priming the pump. Turo, for example, would be useless if it doesn’t have any inventory, but it would be equally pointless if it doesn’t have anybody to rent its cars.

Getting to a point of equilibrium is notoriously hard. Too much inventory and the equipment owners get restless because nobody is willing to rent anything. Too many renters, and that side of the equation falls apart, because it gets too expensive (owners are likely to crank up the price), or there isn’t any equipment available.

It’s a delicate dance, but BoxedUp has an elegant solution: Solve the supply side of the market by buying a bunch of equipment it can rent out. That means it can focus its marketing efforts on the renters and fully control the experience. Once it gets traction, it can communicate what it learned to the supply-side along with data about what types of equipment customers want and are willing to rent.

Traction, market segmentation and storytelling

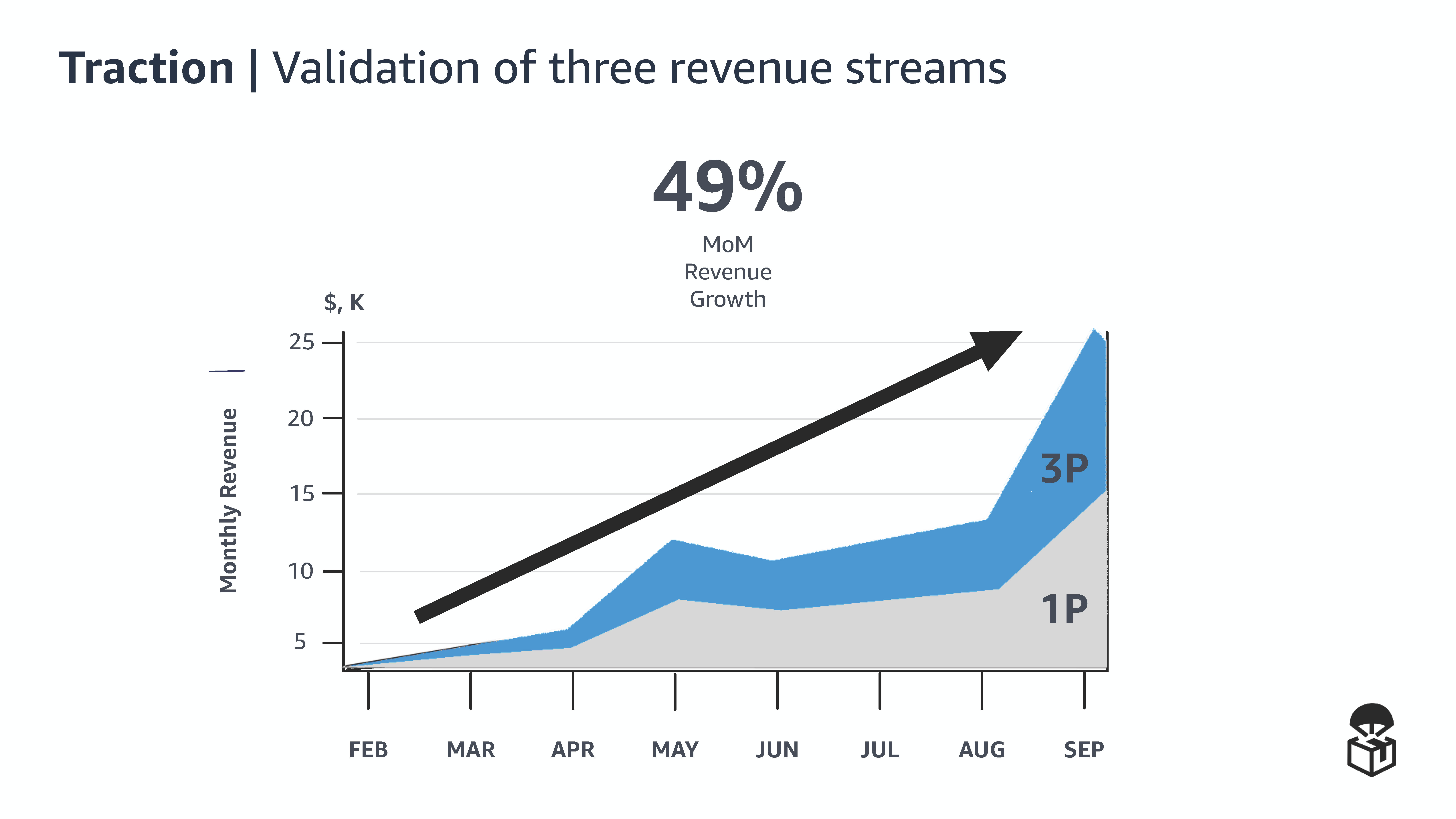

[Slide 14] Rapid revenue growth and smooth growth across both its business models paint a promising picture. Image Credits: BoxedUp (opens in a new window)

I rarely feature three slides in a row in these teardowns, but I wanted to highlight how slides 12, 13 and 14 together tell an important part of the story.

Slide 12 explains the size of the market for its initial customer; slide 13 shows how the company is tackling one of the hardest problems with a marketplace economy (supply and demand side imbalance); and slide 14 shows that the strategy is working. There’s about a 50-50 split between first-party rentals (i.e., BoxedUp’s own equipment on the platform) and third-party rentals (i.e., marketplace rentals).

Of course, these numbers reflect the business in September and we don’t know what happened since, but if the company managed to keep its growth trajectory, I’d be very surprised if I don’t end up writing about the company raising a monster Series A round very soon.

Getting storytelling and narrative arcs right is crucial in pitches, and these slides do three things extremely well: There’s very little content on the slides, so there’s no confusion about what the founders want you to look at; they tell a clear and unambiguous story; and the three slides work in perfect concert.

In the rest of this teardown, we’ll take a look at three things BoxedUp could have improved or done differently, along with its full pitch deck!

Three things that could be improved

BoxedUp successfully answers some of the hardest parts of a marketplace startup story in its deck and deserves major kudos for that part of the pitch.

Other aspects of its deck were a little bit more confusing to get a handle on, however.