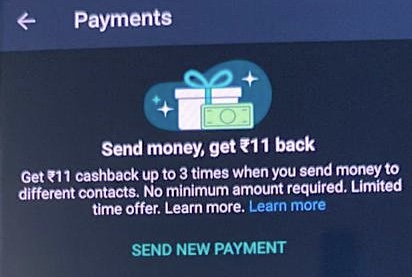

WhatsApp, the most popular smartphone app in India, is employing one of the most popular strategies that has proven to drive users in the world’s second largest market to a service: cash-back. The Meta-owned instant messaging service is running a campaign as part of which it is giving away about 11 Indian rupees, or 14 cents, up to three times to users if they send money to three different people on the app, according to users and an official company support page.

The reward comes at a time when WhatsApp is attempting to expand the reach of its mobile payments service in India. Even as WhatsApp began exploring mobile payments in India as early as 2017, regulatory pushback has prevented the popular app from aggressively expanding its payments service.

WhatsApp got some relief earlier this month when the National Payments Corporation of India, the payments body that oversees the popular payments protocol UPI, which WhatsApp is using, permitted the messaging firm to extend the payments service to 100 million users, up from 40 million earlier.

WhatsApp, which began testing the cash-back rewards in India as early as November of last year (if not earlier), is extending the perk to users who have been using the app for at least 30 days and have registered for payments on WhatsApp by adding their bank account details.

WhatsApp Business users are not eligible.

“We’re introducing a cashback promotion for selected WhatsApp users. If you become eligible for the promotion, you might see a banner within the app, or a gift icon when you’re sending money to an eligible receiver,” the company says on the support page.

Image Credits: TechCrunch

WhatsApp is not the first service to offer cash-back rewards in hopes of courting users. Google also offered users in India about 65 cents for making their first payments transaction when it launched Tez (since rebranded to Google Pay) in 2017, and has since offered as much as $40 to $50 to users to drive engagement and retention. Local giants Paytm and MobiKwik have also delivered cash-back to users for years in the country, and continue to offer similar perks for certain features on the app.

The cash-back should help WhatsApp accelerate its efforts to make inroads in India’s mobile payments market, which is currently dominated by Google and Walmart-backed PhonePe.

WhatsApp says on the support page that it won’t be offering cash-back for QR code payments, or money sent on collect requests. Users sending payments to users with UPI ID on other apps will also not be eligible.

In a statement, a WhatsApp spokesperson said: “We are running a campaign offering cashback incentives in a phased manner to our users as a way to unlock the potential of payments on WhatsApp. Offering safe, secure and easy-to-use digital payments is an important part of scaling India’s digital economy, and we’ll continue to drive awareness of payments on WhatsApp as part of our broader efforts to bring the next 500 million Indians onto the digital payments ecosystem.”