Rupifi has raised $25 million in a new financing round as the Indian startup, which currently provides buy now, pay later service to several marketplaces to serve their merchants, looks to expand its business-to-business payments offerings.

Tiger Global and Bessemer Venture Partners co-led the two-year-old startup’s $25 million financing round. Existing investors Quona Capital and Ankur Capital also participated in the round, a top executive said Thursday.

The new investment, especially from high-profile global investors, shows the appetite many have for the buy now, pay later space, a category that has made deep inroads globally in recent years, and their bullishness on young firms in India.

Rupifi works with over two dozen business-to-business marketplaces including Walmart, Flipkart and Jumbotail to serve their merchant partners, many of whom are mom and pop shop operators, with credit (working capital). The ticket size of these checks ranges from ?10,000 ($135) to ?10,000,00 ($13,500).

The startup sifts through the partner marketplace’s data for its underwriting – on who should get a credit and its size. Rupifi, which largely works with non-banking financial companies to source the capital, has provided credit to over 50,000 sellers so far, Anubhav Jain, co-founder and chief executive of the startup, told TechCrunch in an interview.

“Our B2B BNPL is currently operating at some of the category leading B2B marketplaces in India across sectors such as FMCG, pharma, fashion, electronics, agriculture and food,” he said.

Access to capital is the biggest challenge merchants face in the world’s second most populous nation. Small businesses, especially mom-and-pop shops, rely on money they secure from selling their existing inventory for buying their next batch.

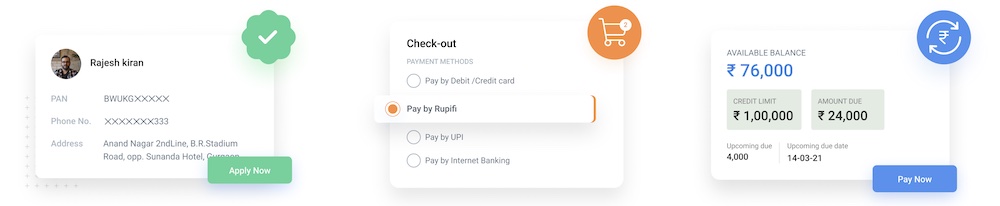

The workflow of Rupifi’s BNPL service. (Image credits: Rupifi)

A timely shot of working capital enables these merchants, who otherwise run some of the world’s most economically sound businesses, to significantly boost their revenues, several industry figures have shown.

Buy now, pay later is Rupifi’s marquee offering today, but Jain, who previously worked at American Express, Razorpay, and sold his edtech platform StudyBud in an all-cash deal, said that the startup will be expanding its product offerings in the next few months.

“What we are saying is that BNPL is just one of the payment instruments that the merchants are using,” he said. The startup is now building an embedded checkout product – which, like its BNPL offering, will sit within the partner firm’s app and website – and will power any payment option including cash to process the payment. “The goal is now to move to B2B payments and checkout.”

Another product it has started trialing is a commercial card. Jain said the card is aimed at small businesses and enterprises that has exceedingly demonstrated good behavior with our BNPL service. “They can use the card at any place, even if we are not integrated with that business,” he said.

“We have had the experience of working with more than hundred B2B and SaaS founders,” said John Curtius from Tiger Global, in a statement. “We understand that globally B2B payments are broken and largely manual. In the $1 trillion B2B commerce and payments space in India, Rupifi has demonstrated rapid growth and proven product leadership.”