More capital has been raised in the private markets than the public markets for over a decade, and this staggering growth has shown no signs of slowing. As private investment booms, companies are developing new tools to help investors navigate these markets, which can be opaque and inconsistent when it comes to reporting performance data.

New York-based Arch has entered the fray with $5.5 million in fresh seed funding for its aggregated private investment management platform, the company announced on Wednesday.

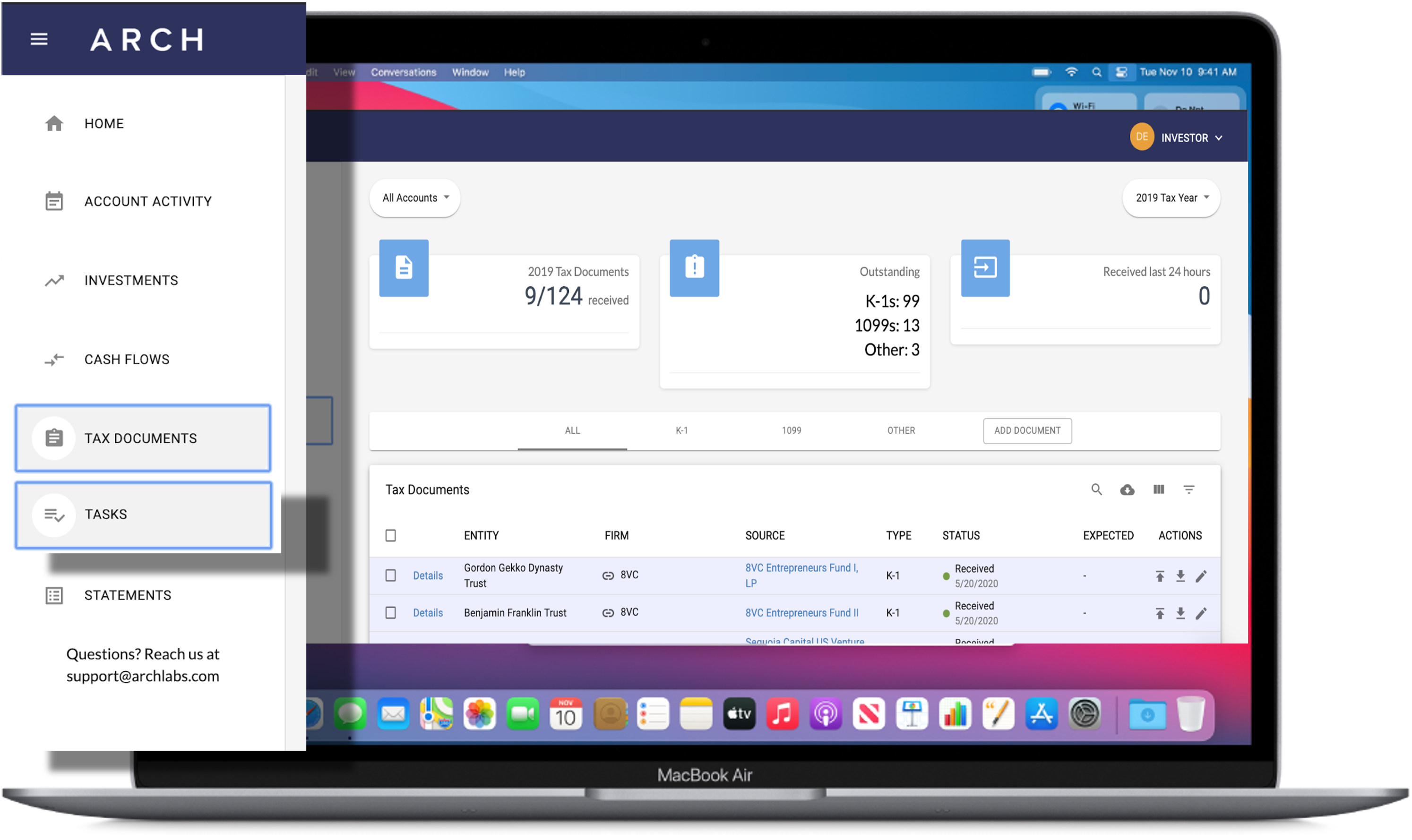

Arch’s task and tax management functions Image Credits: Arch

Arch likens itself to investment management platform Fidelity, but for private investments. It automates “everything that isn’t advice” for investors, advisors, and accountants, co-founder and CEO Ryan Eisenman told TechCrunch.

Eisenman, who worked for an investment advisor while in college, started building Arch in early 2018 alongside his co-founders Jason Trigg and Joel Stein, both MIT-educated software engineers. They set out to aggregate information on one platform from various private investment managers, many of whom tend to have their own internally-built portals to manage data.

“We aggregate data from over 5000 different firms, and we can really manage any firm. We have a process that’s scalable – whether we’ve connected with them in the past, or if they’re a new firm, we can connect with them,” Eisenman said.

Arch plans to use the proceeds from the seed round to hire new talent in operations, partnerships, and engineering, with the expectation of doubling its ten-person headcount by the end of next year, Eisenman said.

The new hires will help support its goal of expanding its platform to support a wider base of institutional investor types, including foundations, endowments, and pension funds. It has just over 100 clients today, most of which are investment advisors and family offices, Eisenman said. Arch does not have any full-time salespeople yet, which it hopes to add with this new capital, he added.

For new firms sharing data with Arch, the onboarding process is low-touch, as the firms share the same information with Arch as they do with their clients, Eisenman said.

Arch’s clients, the investors, report spending 35% less time on average managing their investments because of the efficiencies the platform provides by displaying information like company updates, tax information, capital calls, and cash flows all in one place.

“There’s a ton of things that investors no longer need to do [with Arch]. They no longer need to log into a portal, pull down a document, file the document, make sense of it, pull data from the document, potentially put data into systems – all of that is fully automated for them,” Eisenman said.

“Instead of getting tens, or sometimes hundreds, of emails, they get one email every day that summarizes all the actions they need to take and all the other information that’s come in, and then gives them direct links to that information into the documents themselves,” he continued.

Arch’s consolidated investment portal Image Credits: Arch

Arch also links to wealth management platform Addepar through its transactions API, as well as other popular databases including APX and Black Diamond, allowing Arch’s clients to integrate their performance reporting across the various platforms they use.

Since its launch in June 2020, it has grown annualized recurring revenue (ARR) by over 1,100% and expanded its assets under management over 2,300% to $8 billion, the company says.

Craft Ventures led the seed round alongside several prominent angels, including Warby Parker co-founders Neil Blumenthal and Dave Gilboa, Carta CEO and co-founder Henry Ward, Harry’s founder Jeff Raider, Allbirds founder Joey Zwillinger, and Doordash founder Tony Xu.

Over 25 current Arch clients also participated because they understood the need for Arch’s software firsthand, according to the company.

“The ability to also include people that have supported us early as clients, as investors in our last round, was something that we’re extremely proud of. We love creating situations where we can all be aligned and win together,” Eisenman said.