In his latest TC+ post, growth expert Jonathan Martinez looks at the grim realities of user acquisition. The plain fact is, few of the people who are motivated enough to make it all the way through a registration flow ever create any value.

“Approximately 95.87% of iOS users drop off after day 30,” writes Martinez. “As a startup founder, how do you prevent leakage after spending significant resources to acquire people at the top of the funnel?”

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

For starters, product teams need to identify optimal activation metrics that spotlight the right users — the ones who find utility and delight in your offerings.

“This can be platform-usage minutes, the number of messages a user sends, how many people a user follows, the number of times a user personalizes their avatar, or anything that provides a signal on how users are finding value in your product.”

The investors I’ve spoken to recently are still open to good ideas, but when they come from founders who are already working toward product-market fit, it boosts their confidence.

The small improvements you make by by tweaking onboarding processes or fine-tuning lifecycle emails could help you close your next round.

Thanks very much for reading,

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

3 investors explain why earned wage access startups are set to cash more checks

Image Credits: Liia Galimzianova (opens in a new window) / Getty Images

Workers with low-wage jobs often experience cash-flow problems.

Because so many don’t have access to credit or savings, a growing number that once depended on predatory lenders can now tap into their wages before payday via earned wage access (EWA).

“The potential for this model is huge, but the industry is still very much in its early stages,” reports Karan Bhasin, who interviewed three active EWA investors to learn more about where the industry is headed:

- Jennifer Ho, partner, Integra Partners

- Aris Xenofontos, partner, Seaya Ventures

- Aditi Maliwal, partner, Upfront Ventures

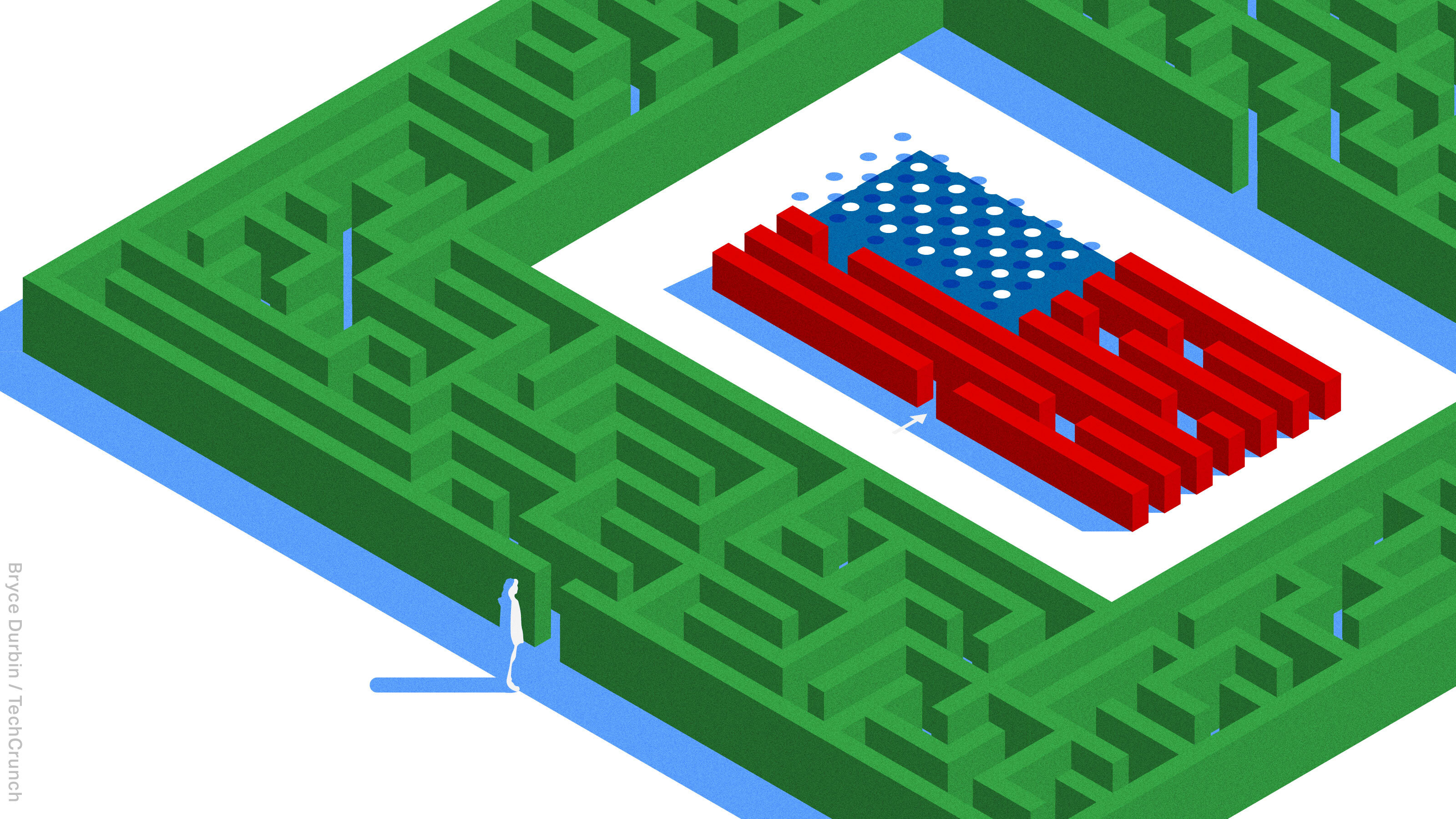

Dear Sophie: Is there a way to keep working in the US after my J-1 visa expires?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I’m a Fulbright Scholar on a J-1 visa. I’ve been told that after my J-1 ends, I’m required to return to my country for two years.

Is there a way I can stay in the U.S.? Can I apply for an O-1A or green card even if I have to go back to my country?

— Seeking to Stay

Getting serious about Series B: 3 documents that help founders control the narrative

Image Credits: davidf (opens in a new window) / Getty Images

Investors who have an entrepreneurial background possess unique insights into the fundraising process, so we have two posts by Gaetano Crupi, a partner at VC firm Prime Movers Lab.

Crupi has spent the pandemic era supporting Series B startups, so he shared an article that examines how a strategy memo, a pitch deck, and a forecast model work in tandem to steer potential investors through diligence.

“This is a great way to control the narrative and ensure that what you want to be transmitted is received by the other parties.”

Pitch Deck Teardown: Helu.io’s $9.8M Series A deck

Image Credits: Helu (opens in a new window)

Helping small- and medium-sized enterprises with their controlling, reporting and budgeting may not sound exciting, but Austrian fintech startup Helu.io’s storytelling skills excited investors enough to help it raise a $9.8 million Series A in July.

With the exception of some details regarding unit economics and revenue, Helu shared its entire winning pitch deck with us. As these slides suggest, its founders took a straightforward approach:

- Problem: “The CFO’s pain is Excel”

- Solution: “Good-bye Excel sheets”

TechCrunch+ roundup: Growth activation metrics, 3 keys to Series B, pitch deck teardown by Walter Thompson originally published on TechCrunch