More companies are adding payments and other financial features to their offerings; however, this often requires technical expertise that some don’t have.

Enter Deposits, a Dallas-based finance startup offering a cloud-based, plug-and-play feature to simplify the implementation of digital banking tools for companies like credit unions, community banks, insurers, retailers and brands.

Co-founder and CEO Joseph Akintolayo started the company with Daniel Paramo in 2019 after years of working with banks and listening to people describe how they want their money to work.

“They are often describing something that sounds kind of like a credit union,” he told TechCrunch. “They want to feel ownership. They want to make sure that it supports their community. They want to feel in charge and that it’s personalized and communicates with them.”

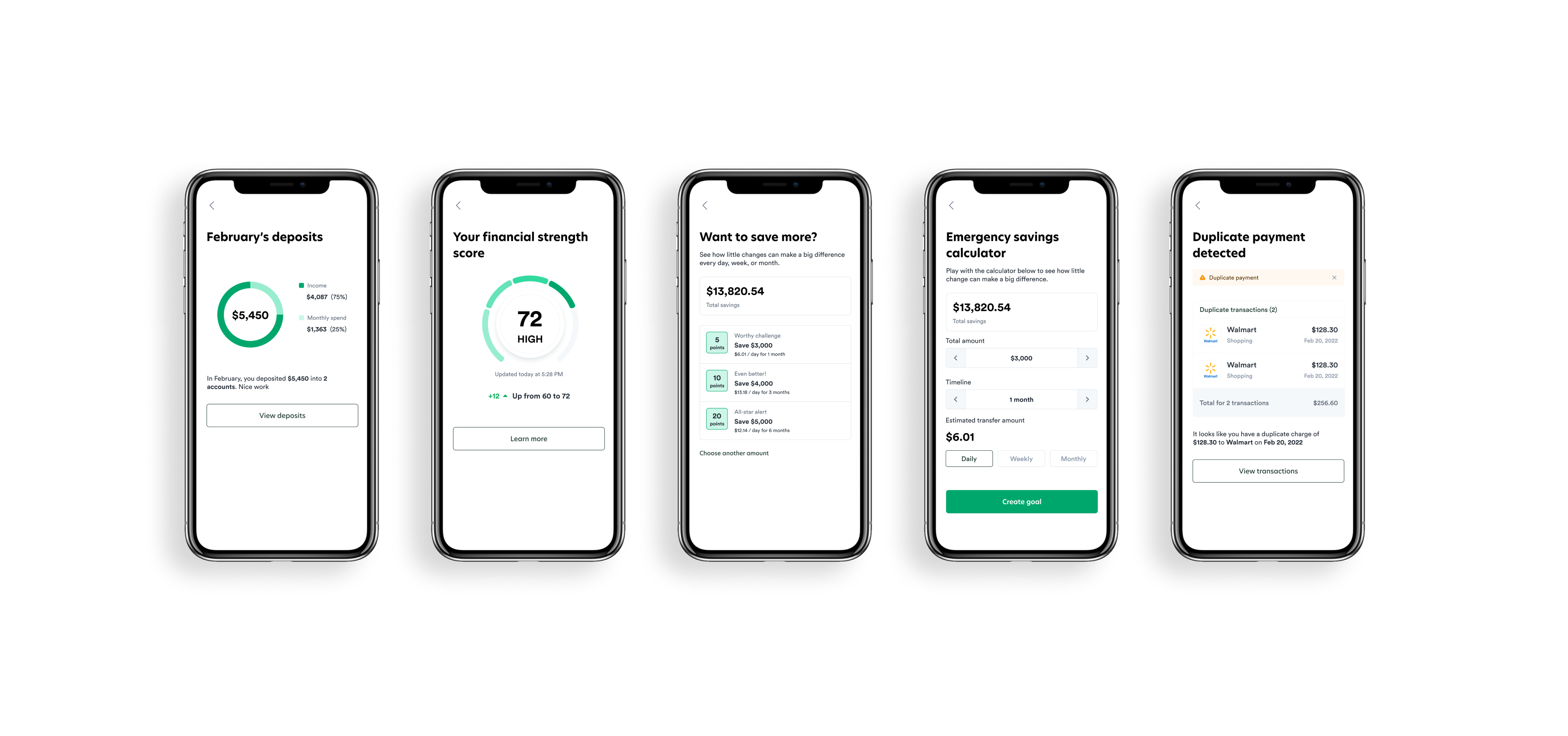

Deposits’ app features Image Credits: Deposits

When he looked at what his clients on the agency side could provide, he saw a big gap between what people were asking for and what banks were able to provide. For example, only the biggest of banks could really offer modern experiences. However, that comes at a big cost to people who are underbanked or who can’t afford monthly fees, Akintolayo explained.

“What’s left are people with a ‘will,’ and community banks and credit unions without a ‘way,’” he added. “Deposits was born to bridge community institutions and brands that really have a passion for serving consumers with the tools that they actually needed to serve consumers in a modern fashion.”

The company enables its customers to quickly and easily put together a package of features, including mobile apps, debit and credit accounts, mobile deposits, virtual cards, peer-to-peer payments and online accounts with identity verification. They can also offer services like home and auto loans and foreign exchange.

Deposits partners with a number of banking, credit and payments partners to facilitate its series of modular “kits” using no-code or low-code tools and APIs that include business banking, money management, identity verification, embedded finance for shopping and checkout and workplace needs.

The company joins other fintech companies catering to credit unions and small banks, like Narmi, Bankjoy and Xend Finance in receiving venture capital funding for their approaches. In Deposits’ case, it announced today its first investment, a $5 million seed round led by ATX Venture Partners with participation from Cabal Fund, Lightspeed Venture Partners and others.

“The first wave of embedded fintech platforms demonstrated demand but required deep technical expertise and suffered delayed rollouts,” said Chris Shonk, partner and co-founder at ATX Venture Partners, in a written statement. “Deposits delivers on the promise with a low-code platform that literally any credit union or product brand can use. Combine that with the team Joseph has put together, its compelling mission and impressive early traction, it was an easy decision to invest.”

The company’s new capital infusion will be deployed into product development and adding to its team of 27 across sales, marketing and engineering, Akintolayo said. He recently brought on a vice president of business development and will be rounding out the executive team.

Deposits’ platform is still in the early stages, having just launched a little over a year ago; however, Akintolayo said it is already “showing strong signals” that it is ready for a broader market.

“Business has not slowed down for us,” he added. “We’re very bullish on our segment and supporting a very needed and essential part of the economy. The products and services that we offer are needed in both time of plenty and in time of need, and so we feel very good.”