Shein has shown the world how combining social media marketing, data analytics, and China’s well-oiled supply chain has created a $100 billion fast fashion behemoth.

Its success naturally spawns imitators and challengers. Among its fastest-growing challengers is Cider, which, like Shein, relies on China’s responsive clothing manufacturers to sell affordable, trend-led pieces to customers around the world.

Cider has racked up roughly 7.4 million installs across the world to date, according to data provided by market intelligence firm Sensor Tower. That number is dwarfed by Shein, which gained over 170 million downloads worldwide in 2021 and surpassed Amazon as the top shopping app in the U.S. last year.

But keep in mind Cider was only founded in 2020 while Shein started out over a decade ago. And Cider has broken into the crowded U.S. market, which accounts for 43% of its total downloads. In the first half of 2022, it recorded 2 million downloads in the U.S., marking a staggering 1,686% year-over-year growth.

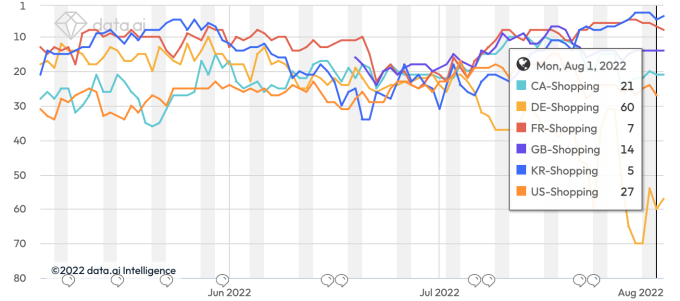

Cider’s other major markets are the U.K., Germany, France, Canada, and South Korea, Sensor Tower finds. It currently ranks among the top 10 shopping apps in the App Stores of France and South Korea, app analytics firm Data.ai shows.

Cider’s App Store rankings over the past 90 days. Data: Data.ai

Shein has grown to be too big to be easily toppled, so startups like Cider are targeting the giant’s untapped niches instead. A browse around Shein today shows the company is increasingly coming after Amazon and is unbounded by its origin in fashion. From pet toys to air purifiers, Shein keeps on widening its product offerings.

Cider, in comparison, is more focused. It clearly wants to be the go-to shop for Gen Z consumers with its array of Y2K looks of crop tops and vibrantly colored tees.

The startup’s traction is by no means a shock given the list of resourceful investors that it has attracted: a16z, of which partner Connie Chan personally explained how Cider’s demand-driven marketplace works; DST Global, ByteDance’s early investor; IDG Capital, one of China’s most prominent VC firms; and MSA Capital, which bets on global startups inspired by China’s tech business models.

As of last September, Cider had raised $130 million in funding and crossed the $1 billion valuation point.

The company is vague about its physical base, saying only it “has offices in Los Angeles” and employs between 200-500 employees, according to its website. It won’t be surprising if the firm announces one day that its headquarters is outside China. Over the past few months, Shein, which has for years clung to the narrative that its inception was inspired by its founder’s trip to LA, has been shifting its key assets to Singapore.

As China tightens control over how tech firms move data across borders and Chinese firms become increasingly ensnarled in geopolitical complications, Chinese-founded startups will look to position themselves as “global” companies, whether that’s done through branding or actual corporate structuring.