We cover a lot of health startups here on TechCrunch, and you know what it’s really hard to get any sort of excitement about? An online pharmacy that raised yet another round of funding.

Don’t get me wrong, Alto Pharmacy raising a Series E is impressive, as is raising $200 million. But realistically, those companies often don’t turn up on my radar: They are too big to be startups and haven’t had a liquidity event (i.e., an IPO, an acquisition, or a bankruptcy), so there’s not a lot of news there.

“Company disrupted an existing industry with a new business model, has been doing well for a while, and is now raising more money to do more of the same, except more” is hard to tell a compelling story around. Especially when that — albeit with slightly smaller numbers — was also the story back in 2017. And in 2020, when the company raised a $250 million Series D.

I know that sounds a little lackluster for someone who writes about companies for a living, but, I mean, listen to the founder’s quote from the company’s press release regarding this fundraise:

“We’ve been laser-focused for the last seven years on building solutions to the foundational issues plaguing the broken pharmacy industry. We’re so proud of the progress the team has made, quietly solidifying our position as the market leader in the rapidly growing digital pharmacy market,” said Alto co-founder Jamie Karraker. “We’re thrilled this new funding will enable us to continue to define this evolving industry and to help even more patients get the care they deserve.”

That’s a lot of words to say, well… Yeah: Company disrupted an existing industry with a new business model, has been doing well for a while, and is now raising $200 million to do more of the same, except more.

This is the slide-deck equivalent of a standup comedian standing on a stage, peering into the spotlights, muttering ‘pharmacies, amirite?’

In the fast-moving, sexy world of early-stage startups, it’s often hard to forget that there is a middle ground. Some companies exit quickly for billions of dollars. Some crash and burn in a cavalcade of lawsuits. But as reporters, we are doing ourselves (and our readers) a disservice: There’s a huge number of companies that grind themselves to the bone on the way to success, customer by customer, metric by metric, market by market. Let’s be honest, there are not a lot of companies that raise five rounds of institutional growth funding, with half a billion dollars worth of investment raised along the way.

When you make it that many rounds in and that many years down the line, you had better have some incredible tricks up your sleeve, solid metrics, and some plans for what to do next to get the company to where it needs to be. It seems like Alto did — it told the world about its $200 million fundraise in January this year. Then, on June 30, the company announced it has a new CEO in the form of ex-Amazon exec and 25-year GM veteran Alicia Boler Davis.

Having read all of this, I was curious to see how a company tells the above story in the form of a pitch deck to investors. And, perhaps most notably, which parts of the story don’t show on the pitch deck.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

- Cover slide

- Traction and metrics summary

- Cover slide — Business overview

- “The Current Pharmacy Experience is Highly Inefficient” — Problem slide

- “Pharmacy is the Largest Consumer Industry Still Offline” — Opportunity slide

- “The Current Experience is Broken for Patients and Providers” — Problem slide

- “The Alto Experience Fixes That” — Solution slide

- “Alto Patient Value Proposition” — Value proposition slide

- “Alto Provider Value Proposition” — Value proposition slide

- “With an End-to-End Software Platform Powering the Next Generation of Pharmacy” — Product slide

- “Alto Offers a Differentiated Approach” — Competition slide

- ” Alto Uniquely Aligns the Broader Healthcare Ecosystem” — Market context slide

- Cover slide — Commercial and growth strategy

- Revenue traction slide

- “Our Growth Strategy” — Go-to-market slide

- “Alto is Scaling Rapidly and Efficiently” — Regional rollout slide

- “Alto’s Provider-Driven GTM Motion Drives Patient Engagement, Enabling Wallet and Margin Expansion” — Marketing strategy slide

- “Expansion Opportunities for Alto are Attractive and Significant” — Adjacent market growth strategy slide

- Cover slide — Operations overview

- “The Pharmacy Sits in the Middle of a Complex and Confusing Supply Chain” — Operational chart slide

- Closing slide

The company did remove three slides from the deck it sent me, and some of the numbers in the deck were redacted. Two of the removed slides were product demo screenshots and the last contained financially sensitive content.

Three things to love

There’s a lot of incredibly smooth data and presentation in this 21-slide deck, with some huge wins along the way. Here are three of my favorites:

Hit ’em with data

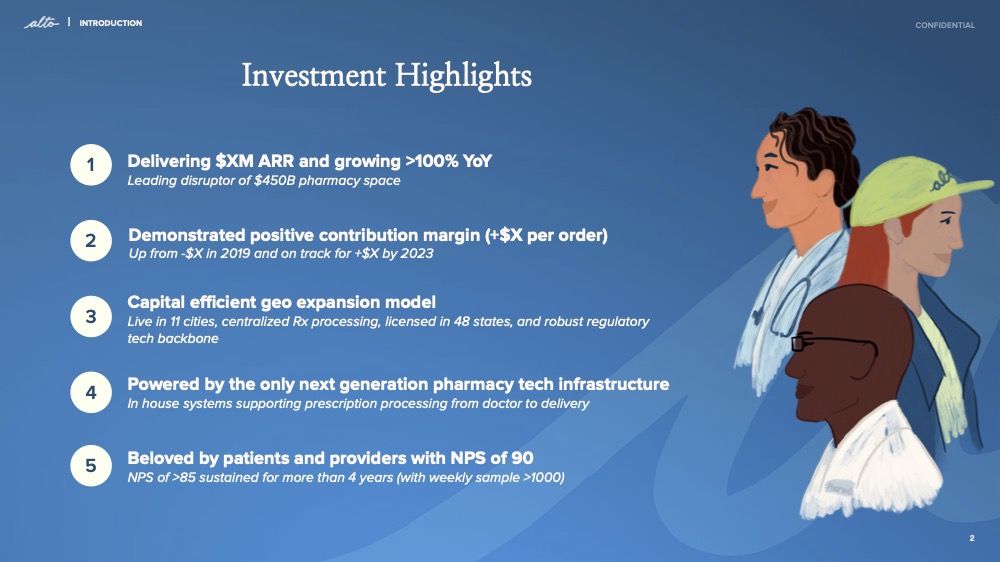

[Slide 2] Getting straight down to business. Image Credits: Alto Pharmacy (opens in a new window)

Traction is everything — that’s true for every startup, but it becomes more and more important the longer the company has been around. Hitting those milestones, growing that growth — it’s the name of the game. Alto doesn’t mess around, crashing straight into a five-point summary of why the investors should show them the money. Frankly, this slide is an award-worthy list of accomplishments.

Doubling its ARR year on year is a hell of a mark of growth that’ll get every investor asking, “How, and can you do it again?” “Positive contribution margin per order” is finance speak for “if we sell more of this stuff, we’ll make more money.” The company also shows that the figure was negative in 2019. That means back in 2019, the company was losing more money the more orders it fulfilled. In the intervening three years, it turned that around, and set an even more beneficial goal for next year.

The geo expansion model is very interesting; if, later in the pitch, the company can convince me that it did 11 geo rollouts and now has a playbook for how to conquer new markets, that could mark the company as a relatively safe bet, for a startup.

Reading between the lines and beyond the business-speak: The company is growing incredibly quickly and has fantastically happy customers. It is out there raising money because its operating and R&D expenses are high enough that overall it is running at a loss. But if it is able to streamline marketing and customer acquisition, it could become a profitable company. And, look! It has a way of rolling out to new markets easily and quickly.

It’s an incredibly good summary of an impressive company, and as an investor (if I invested at the late growth stage), I’d be pretty excited about the next 55 minutes of my life.

‘Mature market ripe for disruption’

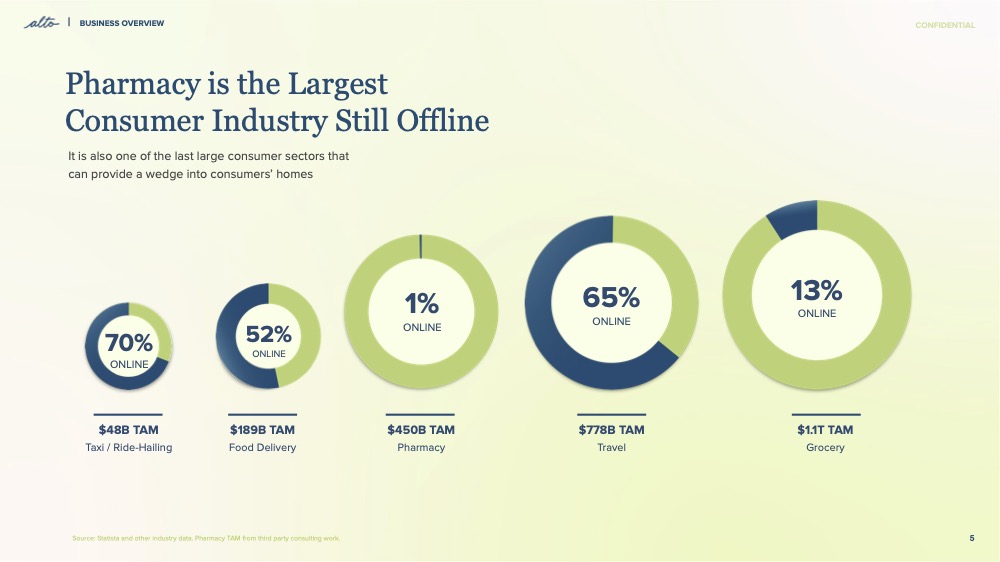

[Slide 5] Let’s goooo. Image Credits: Alto Pharmacy

(opens in a new window)

This slide tells two incredible stories, both related to market size and opportunity. For one thing, as an industry, drugs are bigger than Uber and all food delivery services combined. The other is this: Food delivery and ride-hailing and travel have all gone online, and you can probably think of a dozen unicorns exits in each of those categories. If I were the CEO, I’d be jumping up and down at this point, pointing at that 1% number and strongly insinuating something along the lines of, “How badly wrong do we have to get it to not be successful in this market?”

Based on the company’s performance to date and the enormity of the market — unless there are some major red flags that show up later in this pitch, this is starting to look more and more like a pretty safe investment with a huge opportunity attached. There’s a class of VCs that are entirely geared up to nudge startups that last little way from “doing well” to IPO, and I wouldn’t be at all surprised if we saw one of those in the near future from Alto.

Also, folks, this is how you do a market size slide. It’s so well done.

Let’s traumatize the reader a little

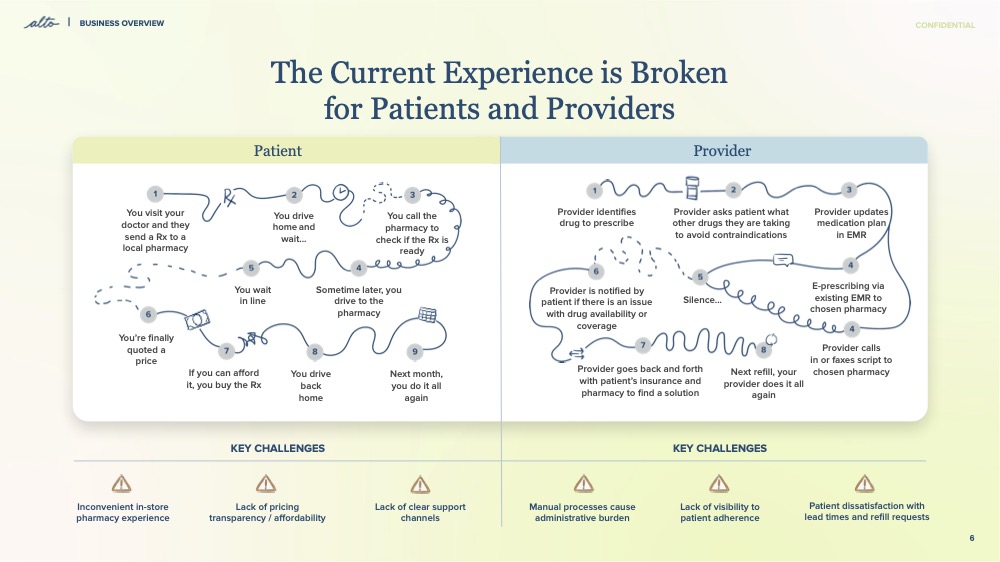

[Slide 6] This is the slide-deck equivalent of a standup comedian standing on a stage, peering into the spotlights, muttering “pharmacies, amirite?” Image Credits: Alto Pharmacy(opens in a new window)

The best storytelling trick in the how-to-pitch playbook is to make it come to life. And, in the U.S., with its unmentionably complicated healthcare, the above diagram is painfully familiar. From procuring a prescription from your doctor to having the drug in your hands can be a Sisyphean task of frustration and murderous rage. By playing into that experience and then waving a magic wand to make it all better, you tickle the empathy bone in your investors.

You get exactly one guess to guess what Slide 7 is.

Oh OK, then, because you asked so nicely:

It is a storytelling trick as old as marketing itself: Set up a painful problem that the audience can identify with, then sell ’em the problem to that same issue in the very next scene.

It’s so simple, but Alto does it so fantastically well here.

In the rest of this teardown, we’ll take a look at three things Alto Pharmacy could have improved or done differently, along with its full pitch deck!