“They told me it’s the kanji character for ‘love,’” Carl Pei explains, “but I call bullshit on that. I can’t see it.”

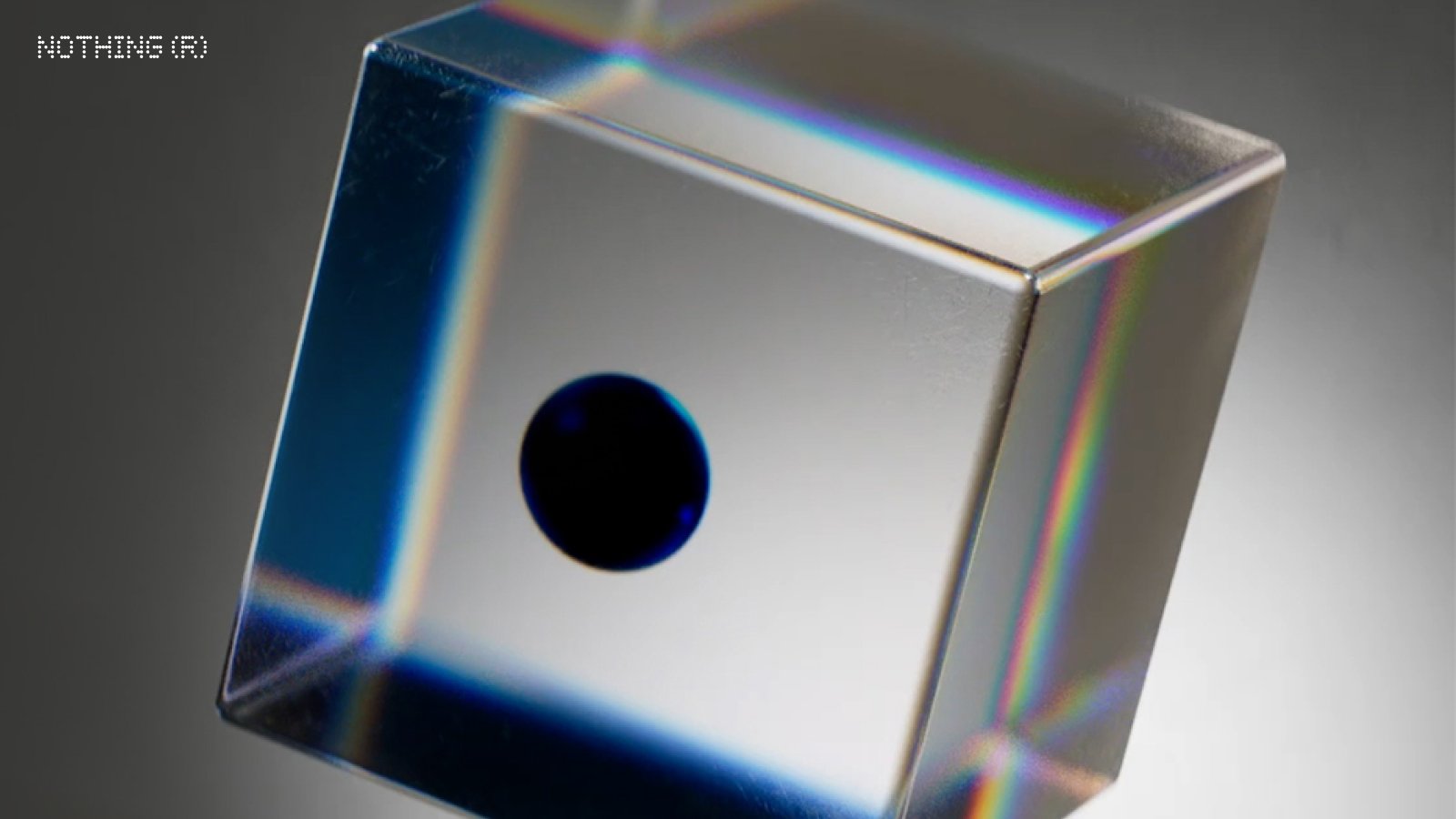

The Gliph design is — by far — the most striking element of the Phone (1)’s design. It’s a series of 900 LEDs spread out and overlaid with a diffuser to create a unique series of lines and curves the beneath the Gorilla Glass 5 that covers that handset’s back. Aeshetics are a key part of Nothing’s hardware play, and like the Ear (1) before it, the device should have no trouble standing out in a crowded and staid category.

The lights flash and pulsate with an extreme brightness — enough to warrant a warning for users with epilepsy and an aversion to bright lights. The brightness can be adjusted in settings, and the flashing can be designated for a variety of different functionalities. At standard brightness, kept on for 10 minutes, it should still have a relatively negligible impact on battery. At the center is a coil for reverse charging other devices at a 5W rate.

“I think it’s quite iconic,” Pei says. “You will recognize it across the room. I know we call it an ‘interface,’ but the functionality is still a little limited. We’ve done that on purpose. We just wanted to go out of the gate with something simple and then add on top of that. Hopefully in the future, it will become more of an interface.”

Image Credits: Brian Heater

The striking feature caps off what is otherwise a surprisingly conventional design. Having used the phone as a daily driver, I’m struck with how much the hardware looks like an iPhone — albeit with subtle differences, like the hole punch camera versus a notch. “I’ve gotten that feedback,” Pei explains. “It’s the most efficient use of space.” Apple’s design language is, of course, as good a jumping off point as any — in much the same way as the Ear (1) strikes a similar profile as AirPods.

Beyond the novelty of its design aesthetics, Nothing’s true strength lies in its community. It was one of the primary drivers in the early success of OnePlus, which Pei co-founded eight years ago with current CEO Pete Lau. A loyal fanbase coupled with reliable hardware helped propel the company in what was already an oversaturated market. OSOM founder Jason Keats cited Pei’s community success as a driving factor in why his company partnered with crypto firm Solana for its first device.

Nothing helped kickstart its own community with the promise of investor equity — a fairly unique approach for a firm that also has a rogue’s gallery of high-profile VC backers, including GV, Tony Fadell, Casey Neistat, Kevin Lin and Steve Huffman. The company has thus raised around $150 million in equity and $65 million in debt, all told — “barely enough” to launch its first handset, according to Pei, given how much the young mobile startup was required to shell out to launch the device.

Image Credits: TechCrunch

One key thing OnePlus had that Nothing lacks is the backing of BBK Electronics, the Chinese conglomerate behind its parent company Oppo, along with competitors like Vivo and Realme. It was an important leg up in a market that has only grown more difficult to crack, as sales have slowed and the market has come to be dominated by a handful of key players like Apple and Google, driving out once important brands like LG and HTC in the process.

“Nothing has been a difficult company to launch,” Pei says. “This industry, in general, has one of the highest barriers of entry. We have huge companies, and it’s consolidating. There are a handful of companies that are active, and huge companies tend to be pretty bureaucratic, slow moving and very analytical. No wonder why all the products are kind of similar these days. In a regular industry or product category, you also have fresh blood that keeps coming in from below. In our industry, there’s no fresh blood because the barrier to entry is so high.”

Image Credits: Nothing’s NFT project (opens in a new window)

Some creativity has been necessary. Along with the crowd equity, the company also created a limited edition NFT to incentivize backers. Its flirtation with such technologies has, naturally, caused some pushback. As Rita recently noted, an Instagram post about the program was littered with user comments like, “What a waste of resources on something completely useless. Rather focus the money on developing the phone or other tech.”

Pei acknowledges the reaction, noting that some negativity is inevitable. The founder himself is quite bullish about web3 in general. In past conversations, he’s described potential future functionality such underlying technology could play in the mobile space. The Phone (1) will feature a taste of that, including things like a widget that lets users view their NFTs on the home screen. The gallery feature also displays floor prices.

But he’s also quick to point out that, unlike the Solano/OSOM device and the HTC Exodus before it, this is not a blockchain device phone, stating that he “believes in the notion of a web3 phone.”

Image Credits: Brian Heater

Pei adds, “I don’t see any customer value today in building a crypto phone. What are you going to get out of it? I don’t know. I’d rather take the things we understand, like community building. I understand why NFT projects have a community around them, and we can figure out how to use that technology to better manage and work with our community.”

In addition to the standard difficulties in launching a brand new mobile device company, navigating the supply chain has been a downright nightmare. Manufacturers were already wary to put their faith in a hardware startup even before so much of the industry ground to a halt. Ultimately, Nothing partnered with BYD, a Shenzhen-based manufacture best known for producing automotive components.

“They’re really trained by Apple to deliver,” says Pei. “They believe in us. In the beginning, not all of the factories wanted to work with us. All the startups that have tried to create smartphones in the past 10 years have failed. Every time they failed, their supply chain partners lost money.”

Image Credits: Brian Heater

Pei won’t give an exact figure for the initial shipment, only stating that the order is in the “hundreds of thousands.” The company ultimately took a few shortcuts, like not getting the device officially IP certified. That means the company can’t make an official claim of water resistance, but he says it should hold up to daily water encounters like puddle splashes and rain. The rear, meanwhile, was subjected to drop tests, and he adds that if users encounter any issues with the backlight, they can send it back to the company for repairs.

The device is powered by Qualcomm’s 778G+, a mid-range chip that is an odd choice for a company positioning its product as a flagship handset. Pei claims the company went with the SoC not for cost-cutting reasons, but rather because Nothing opted for the TSMC-produced fab, rather than Samsung. “It was a difficult choice, because we knew there would be people saying, ‘hey what are you doing? It’s not the latest.’ But I think it’s the most responsible choice in the seven series.”

Image Credits: Brian Heater

The company did manage to keep prices down, however. The handset starts at £399, running up to £499 for the highest configuration. That places the device firmly in the middle of the pack, and while both Nothing and OnePlus seem reluctant to position themselves as mid-tier/budget devices, keeping the products well below four digits is no doubt part of their broader consumer appeal. The handset features a 6.55-inch display with a 12Hz refresh rate and a pair of rear-facing 50-megapixel sensors.

Unlike OnePlus, however, Nothing’s first phone won’t be making it to U.S. shores. The world’s third-largest smartphone market is a notoriously difficult one to crack. Pei says he expects the U.S. to become the company’s “most important” market, long term, but for now, it’s simply won’t make it out here. While many American consumers have grown more savvy about purchasing unlocked devices off-contract, carriers are still a huge barrier of entry.

Image Credits: Brian Heater

“You have to work with a big carrier,” Pei says, “they have a lot of negotiation power over you.” The hope, ultimately, is that once the company makes more of a name for itself, the ball will ultimately be in Nothing’s court. For now, it will have to focus on other markets.

“[India is] a very tech savvy market,” he says. “It’s very social media savvy — it’s a very young country. That just happens to be what we’re good at — social media, working with tech bloggers and YouTubers. Our messages have been landing really well in India.”

The phone’s success will also determine Nothing’s roadmap and release cadence, moving forward. While the company came out of the gate with an ambitious plan to tackle numerous hardware verticals, its ambitions could come crashing to the ground if the Phone (1) isn’t a success out of the gate.

Image Credits: Brian Heater

“We have other products in the pipeline, but the performance of the Phone (1) is really going to affect the roadmap,” he says. “With the Ear (1), we proved ourselves in a small way, to then be able to raise capital for the Phone 1 and also attract more qualified staff and supply chain partners.”

The phones will also, ultimately, impact whether Nothing goes back to the funding well. “We will go and feel out the temperature in the market after the launch, after we have all the data we need, like the sales figures,” Pei explains. “We don’t need to take money at all costs. If there are terms we believe are mutually beneficial to us an investors, we are open to taking some more money. It’s always good to have cash as a buffer for your business. It makes it more resilient, but we also have a business plan that doesn’t require more money.”