To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT (except today because of the breaking Musk news!), subscribe here.

Jet-lagged and post-COVID-fatigued, Haje is back, joining Christine to bring you fine morsels of tech news in this very newsletter. Also, hearsay (and the calendar) suggests that it might be Friday. If that almost unverifiable rumor is, in fact, true, then have a delightful weekend. — Christine and Haje

The TechCrunch Top … 4

- Friday Musk news dump: We had the newsletter all set to go, but as is wont to happen late on a Friday, there is some breaking news. And once again, it’s about Elon Musk. The CEO of many companies, and the apparent father to a new set of twins with an executive of one of those companies, decided to terminate his deal to buy Twitter. But Twitter’s not really having it and said as much in its single-paragraph, two-sentence response to the news. This is a developing story so keep your eyes right here for the latest.

- Check, please: This is such a well-done story by Kyle that goes into detail about the fall of Butler Hospitality, which raised $50 million last year. Then it ran into several challenges that ended with the company, which essentially leased hotel kitchen space to others to operate as a ghost kitchen, laying off hundreds of people and not being able to fulfill its commitments.

- Well, isn’t that a jolt to the senses: There may be many reasons why someone doesn’t invest in an electric car, but Tim’s story today suggests that a big one is not enough trust in the public charging infrastructure. It’s a legitimate fear, really, because that 600-mile trip is going to end badly if there isn’t a reliable and quick place to plug in along the way.

- The electric vehicle charging hunt is afoot: Where Tim’s story was talking about electric vehicle chargers in general, another top story for today was Jaclyn’s, who wrote that the White House wants to expand charging capabilities and that Elon Musk is on the case, working to expand Tesla’s Supercharger network.

Startups and VC

Coalition, a San Francisco–based startup that combines cyber insurance and proactive cybersecurity tools, is preparing to expand outside of the U.S. for the first time following a mega $250 million Series F round that takes its valuation to a whopping $5 billion, Carly reports.

We also particularly enjoyed the interview Connie did with Sequoia Capital’s Jess Lee, regarding its new Arc program, and whether or not it’s a competitor to Y Combinator. “We’re really looking for founders who want to build long-term, transformational, category-defining companies … that carve out a new market. There is no one we’d rule out, but it’s more about the scale of ambition,” Lee shares.

Our money doesn’t jiggle jiggle, it folds:

- Drop it like it’s hot: Former Theranos exec Sunny Balwani is found guilty on a lot more counts than the company’s CEO Elizabeth Holmes was, Amanda reports. Sentencing will happen in November.

- Well, you wood say that: The climate nerd in us is psyched by Mike’s story about one startup’s hopes to get us to net-zero via its platform to construct wooden buildings.

- It’s (not) only rock ’n’ roll but I like it: All of Universal Music Group’s music will be available on Mdundo, after the African streaming service inks a licensing deal, reports Annie.

- Compra con un clic: DEUNA, a Silicon Valley–based one-click checkout commerce startup, is entering Latin America’s crowded one-click checkout market with $30 million in Series A funding after largely staying under the radar since being founded in late 2020, Christine reports.

- Blockchain, meet smartphone: Smartphone start-up OSOM’s CEO discusses the company’s Solana partnership in this fascinating interview with Brian.

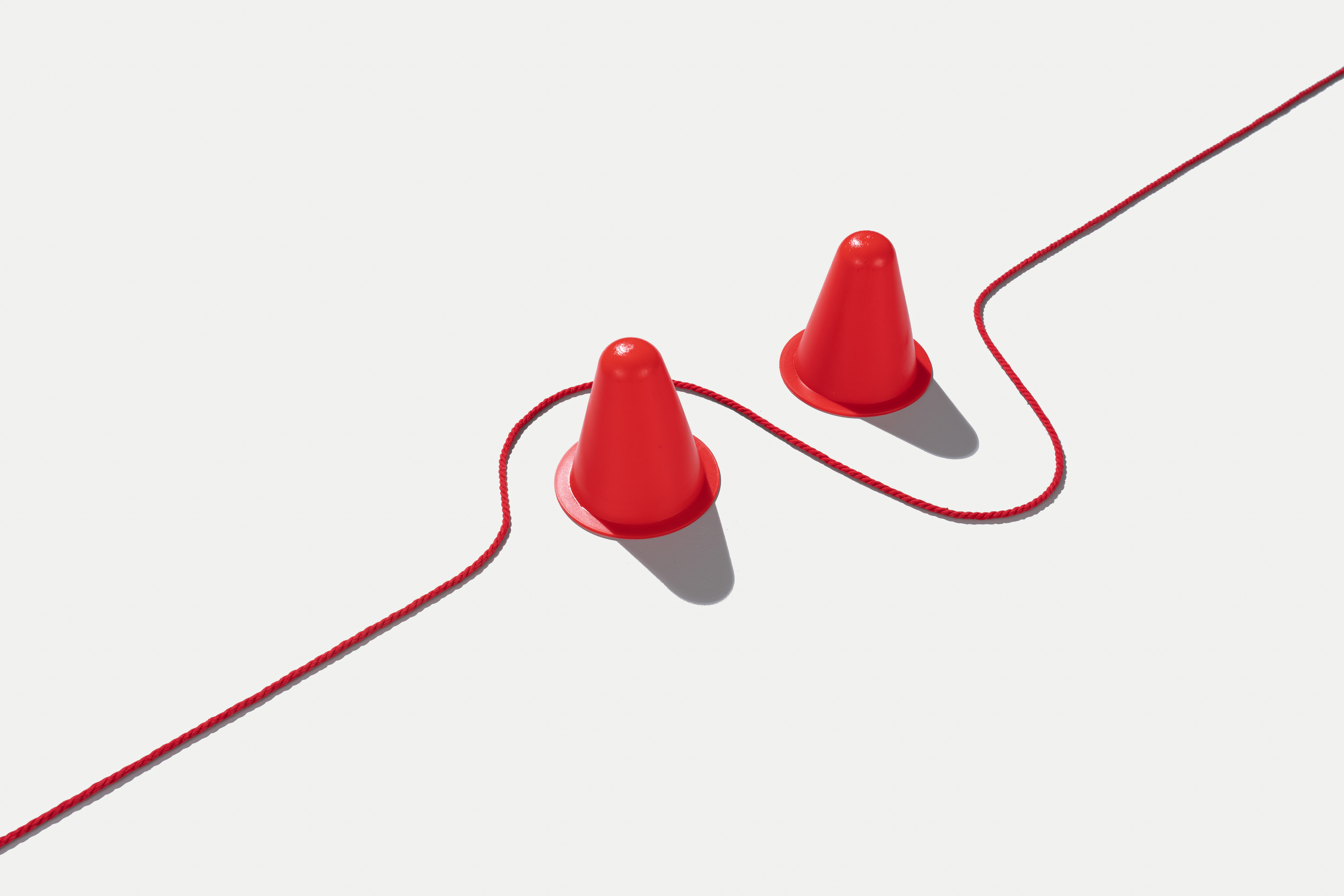

The art of the pivot: Work closely with investors to improve your odds

Image Credits: MirageC (opens in a new window) / Getty Images

For her latest TC+ post, we asked veteran investor Marjorie Radlo-Zandi to share her playbook for helping first-time founders steer their companies through a pivot.

Changing direction is a massive undertaking, but she breaks the process down into several steps that will help entrepreneurs get buy-in from investors (and employees).

“There’s no shame in pivoting,” writes Radlo-Zandi. “On the contrary, it’s a sign of strength.”

(TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Big Tech Inc.

We first focus on a story Taylor put together this afternoon about a Congress investigation into period tracking apps and the data associated. With Roe repealed, there is concern that this kind of data may pose a threat to those seeking reproductive care.

We can sum up today’s — well, technically late yesterday’s — big tech news in three words: Twitter, cars, yacht. Not to be confused with gym, tan, laundry.

Amanda reported on Twitter targeting its talent acquisition team by laying off 30% of that workforce. The company declined to go into specifics, so we don’t know exactly how many people that is, but it’s safe to say jobs at Twitter will not be filled for a while. If that wasn’t already enough Twitter trouble, Taylor follows up on a report that suggests Elon Musk is not interested in buying the company anymore.

But wait, there’s more:

- No one at the wheel: The layoffs continue, this time over at Argo AI, which is testing driverless technology for automakers like Ford and Volkswagen, Kirsten reports.

- That’s hot: SpaceX is taking a spin at developing a more reliable internet service for those at sea, Andrew writes.

- Can you hear me?: Lauren writes about Netflix’s spatial audio feature rolling out to all of its devices so your home can be just like the theater.

- Roofer, we hardly know her: Yes, yes, not that funny of a joke. Christine knows of only one person in her neighborhood who put on a Tesla solar roof, and according to Harri’s story, that was one of maybe 20 per week Tesla installed in the second quarter, far below the 1,000 per week it originally planned.