The banking industry isn’t always welcoming to startups, depending on the market’s outlook. As inflation rises and companies brace for the worst, once-promising neobanks are being forced to face the music. For example, Varo Bank, the first neobank to be granted a U.S. bank charter, recently revealed that it could run out of cash by the end of the year.

Still, it’s true that venture capitalists continue to put record capital toward fintechs, with one estimate pegging the total amount invested in Q1 2022 at $28.8 billion. That’s perhaps why Nikhil Lakhanpal and Chris Griffin, the co-founders of Narmi, a fintech company launched in 2016, are undeterred by the headwinds.

Narmi is a beneficiary. The startup today closed a $35 million Series B funding round co-led by Greycroft, NEA, and Picus Capital, bringing Narmi’s cash raised to date to ~$60 million.

“Given the worldwide shift toward digital and growing user expectations, we felt that a solution needed to be made to meet the challenges of tomorrow,” CEO Lakhanpal told TechCrunch in an email interview. “We are of course selling to a customer base that historically has been slower to innovate and culturally are risk-averse. This is the nature of the business, and we accept that. We have a big challenge where Narmi really needs to be a true consultative partner to the financial institution and help them understand the return on investment and scalability of digital products, but we consider this challenge our job.”

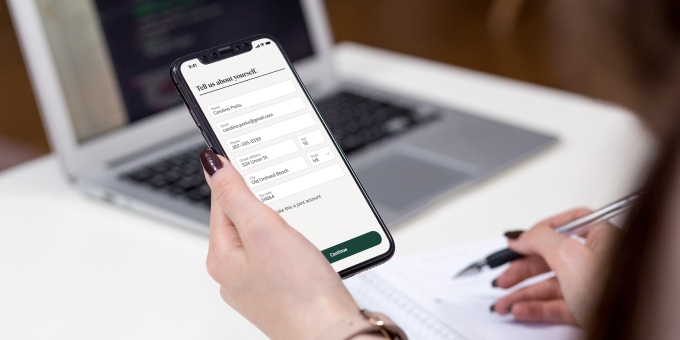

Image Credits: Narmi

Both Lakhanpal and Griffin came from the financial industry, where they spent several years working at incumbent banks like Citi and Barclays. Narmi arose to address what Lakhanpal describes as a lack of digital innovation in banking, which he and Griffin believe was inhibiting growth at their previous employers.

While New York, New York-based Narmi isn’t a bank, it provides mobile, online, and digital account banking to regional and community financial institutions.

“Today, financial institutions have little choice but to offer intuitive, feature-rich, and well-designed digital platforms to consumers and businesses,” Lakhanpal said. “Narmi addresses this need through its API-driven platform that grants financial institutions access to Narmi’s many products to drive growth, deposits, and cost efficiencies.”

Narmi fits into a category of fintech companies that layer services on top of existing banking infrastructure. Competitors include Yapily, which provides a unified banking API for several European markets, including France and the U.K. Slink is a banking and payment platform aimed at software development teams. In Latin America, there’s NovoPayment.

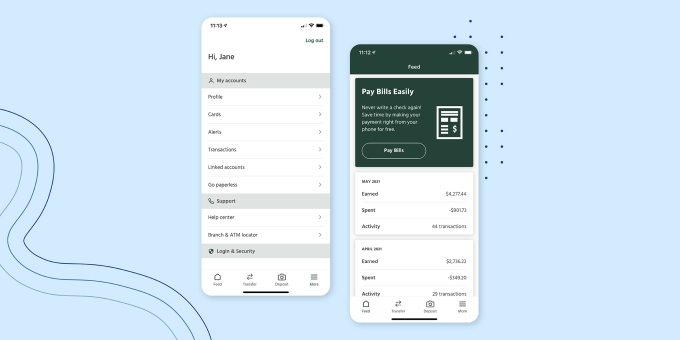

Narmi offers products including digital account opening, business digital account opening, consumer digital banking, business digital banking, and an administrator console. Recently, the company launched Narmi Analytics, a capability designed in partnership with Sisense to help users create personalized reports and dashboards. And this summer, Narmi plans to launch a business account opening platform geared toward banks with small- and medium-sized business customers.

“The biggest problem with our competitors is they focus too much on selling ‘what they have today.’ But these customer engagements are long-term (often five years in length),” Lakhanpal said. “Put simply, Narmi’s technology is the entire customer facing platform of the financial institution. We are the most critical piece of infrastructure a financial institution can purchase. The decision maker or C-suite manager should care deeply about this because we are the platform that their users log into every day and that the bank uses to drive deposit growth or loan growth or cross-sell.”

Image Credits: Narmi

So, can Narmi stand out in a crowded field? Lakhanpal asserts that it can, pointing to a customer base that spans LendingClub, First Internet Bank, and at least one large credit union (e.g., University Credit Union). He declined to disclose revenue and other pertinent details, like the size of Narmi’s workforce. (It’s worth noting that it’s unusual for a company to opt not to reveal its headcount; according to LinkedIn, Narmi has about 66 people on staff.) But Narmi said that the proceeds from the Series B would be put toward hiring, business banking product development, and supporting “middleware” API layers.

“At the start of the pandemic, you saw all these financial institutions really feel just how important having a modern and elegant digital experience matters … Another lesson from the pandemic is that financial institutions have prioritized two things: digital transformation and an appetite for products that actually move the needle for their financial institution instead of simply ‘checking a box,’” Lakhanpal said. “Previously a bank might say, ‘I think I can open accounts online through my core banking provider.’ Now they say, ‘I can open accounts in two minutes and 13 seconds and I’ve fully automated the identity verification and core banking integration and have a 80% completion rate.’ Put another way, they are digging into the best products and realizing that the return on investment of digital is incredible when you find the right product.”